HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

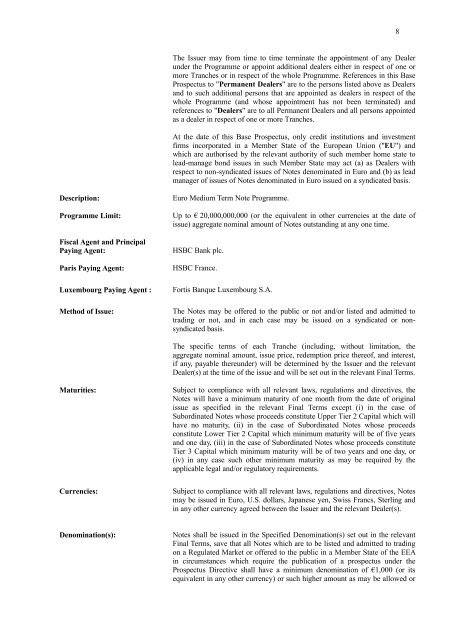

The Issuer may from time to time terminate the appointment of any Dealer<br />

under the <strong>Programme</strong> or appoint additional dealers either in respect of one or<br />

more Tranches or in respect of the whole <strong>Programme</strong>. References in this Base<br />

Prospectus to "Permanent Dealers" are to the persons listed above as Dealers<br />

and to such additional persons that are appointed as dealers in respect of the<br />

whole <strong>Programme</strong> (and whose appointment has not been terminated) and<br />

references to "Dealers" are to all Permanent Dealers and all persons appointed<br />

as a dealer in respect of one or more Tranches.<br />

At the date of this Base Prospectus, only credit institutions and investment<br />

firms incorporated in a Member State of the <strong>Euro</strong>pean Union ("EU") and<br />

which are authorised by the relevant authority of such member home state to<br />

lead-manage bond issues in such Member State may act (a) as Dealers with<br />

respect to non-syndicated issues of <strong>Note</strong>s denominated in <strong>Euro</strong> and (b) as lead<br />

manager of issues of <strong>Note</strong>s denominated in <strong>Euro</strong> issued on a syndicated basis.<br />

Description:<br />

<strong>Programme</strong> Limit:<br />

Fiscal Agent and Principal<br />

Paying Agent:<br />

Paris Paying Agent:<br />

Luxembourg Paying Agent :<br />

Method of Issue:<br />

<strong>Euro</strong> <strong>Medium</strong> <strong>Term</strong> <strong>Note</strong> <strong>Programme</strong>.<br />

Up to € <strong>20</strong>,<strong>000</strong>,<strong>000</strong>,<strong>000</strong> (or the equivalent in other currencies at the date of<br />

issue) aggregate nominal amount of <strong>Note</strong>s outstanding at any one time.<br />

<strong>HSBC</strong> Bank plc.<br />

<strong>HSBC</strong> <strong>France</strong>.<br />

Fortis Banque Luxembourg S.A.<br />

The <strong>Note</strong>s may be offered to the public or not and/or listed and admitted to<br />

trading or not, and in each case may be issued on a syndicated or nonsyndicated<br />

basis.<br />

The specific terms of each Tranche (including, without limitation, the<br />

aggregate nominal amount, issue price, redemption price thereof, and interest,<br />

if any, payable thereunder) will be determined by the Issuer and the relevant<br />

Dealer(s) at the time of the issue and will be set out in the relevant Final <strong>Term</strong>s.<br />

Maturities:<br />

Currencies:<br />

Subject to compliance with all relevant laws, regulations and directives, the<br />

<strong>Note</strong>s will have a minimum maturity of one month from the date of original<br />

issue as specified in the relevant Final <strong>Term</strong>s except (i) in the case of<br />

Subordinated <strong>Note</strong>s whose proceeds constitute Upper Tier 2 Capital which will<br />

have no maturity, (ii) in the case of Subordinated <strong>Note</strong>s whose proceeds<br />

constitute Lower Tier 2 Capital which minimum maturity will be of five years<br />

and one day, (iii) in the case of Subordinated <strong>Note</strong>s whose proceeds constitute<br />

Tier 3 Capital which minimum maturity will be of two years and one day, or<br />

(iv) in any case such other minimum maturity as may be required by the<br />

applicable legal and/or regulatory requirements.<br />

Subject to compliance with all relevant laws, regulations and directives, <strong>Note</strong>s<br />

may be issued in <strong>Euro</strong>, U.S. dollars, Japanese yen, Swiss Francs, Sterling and<br />

in any other currency agreed between the Issuer and the relevant Dealer(s).<br />

Denomination(s):<br />

<strong>Note</strong>s shall be issued in the Specified Denomination(s) set out in the relevant<br />

Final <strong>Term</strong>s, save that all <strong>Note</strong>s which are to be listed and admitted to trading<br />

on a Regulated Market or offered to the public in a Member State of the EEA<br />

in circumstances which require the publication of a prospectus under the<br />

Prospectus Directive shall have a minimum denomination of €1,<strong>000</strong> (or its<br />

equivalent in any other currency) or such higher amount as may be allowed or