2205 final report.pdf - Agra CEAS Consulting

2205 final report.pdf - Agra CEAS Consulting

2205 final report.pdf - Agra CEAS Consulting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

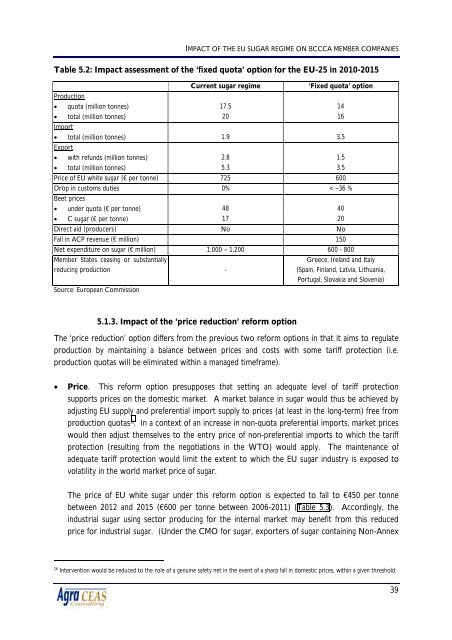

IMPACT OF THE EU SUGAR REGIME ON BCCCA MEMBER COMPANIES<br />

Table 5.2: Impact assessment of the ‘fixed quota’ option for the EU-25 in 2010-2015<br />

Production<br />

Current sugar regime<br />

‘Fixed quota’ option<br />

• quota (million tonnes) 17.5 14<br />

• total (million tonnes) 20 16<br />

Import<br />

• total (million tonnes) 1.9 3.5<br />

Export<br />

• with refunds (million tonnes) 2.8 1.5<br />

• total (million tonnes) 5.3 3.5<br />

Price of EU white sugar (€ per tonne) 725 600<br />

Drop in customs duties 0% < –36 %<br />

Beet prices<br />

• under quota (€ per tonne) 48 40<br />

• C sugar (€ per tonne) 17 20<br />

Direct aid (producers) No No<br />

Fall in ACP revenue (€ million) 150<br />

Net expenditure on sugar (€ million) 1,000 – 1,200 600 - 800<br />

Member States ceasing or substantially<br />

reducing production -<br />

Source: European Commission<br />

Greece, Ireland and Italy<br />

(Spain, Finland, Latvia, Lithuania,<br />

Portugal, Slovakia and Slovenia)<br />

5.1.3. Impact of the ‘price reduction’ reform option<br />

The ‘price reduction’ option differs from the previous two reform options in that it aims to regulate<br />

production by maintaining a balance between prices and costs with some tariff protection (i.e.<br />

production quotas will be eliminated within a managed timeframe).<br />

• Price. This reform option presupposes that setting an adequate level of tariff protection<br />

supports prices on the domestic market. A market balance in sugar would thus be achieved by<br />

adjusting EU supply and preferential import supply to prices (at least in the long-term) free from<br />

production quotas 26 . In a context of an increase in non-quota preferential imports, market prices<br />

would then adjust themselves to the entry price of non-preferential imports to which the tariff<br />

protection (resulting from the negotiations in the WTO) would apply. The maintenance of<br />

adequate tariff protection would limit the extent to which the EU sugar industry is exposed to<br />

volatility in the world market price of sugar.<br />

The price of EU white sugar under this reform option is expected to fall to €450 per tonne<br />

between 2012 and 2015 (€600 per tonne between 2006-2011) (Table 5.3). Accordingly, the<br />

industrial sugar using sector producing for the internal market may benefit from this reduced<br />

price for industrial sugar. (Under the CMO for sugar, exporters of sugar containing Non-Annex<br />

26<br />

Intervention would be reduced to the role of a genuine safety net in the event of a sharp fall in domestic prices, within a given threshold.<br />

39