2205 final report.pdf - Agra CEAS Consulting

2205 final report.pdf - Agra CEAS Consulting

2205 final report.pdf - Agra CEAS Consulting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

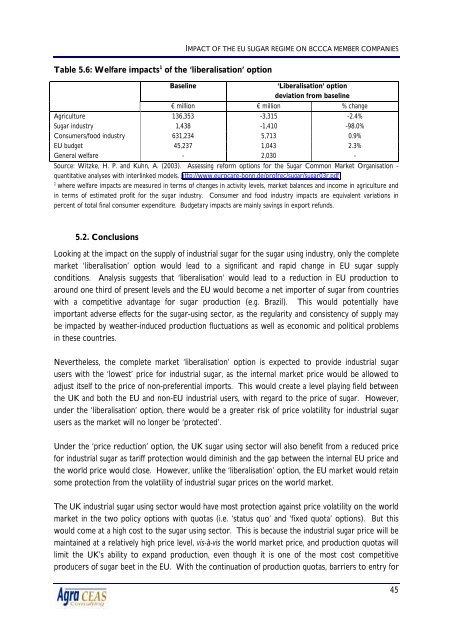

IMPACT OF THE EU SUGAR REGIME ON BCCCA MEMBER COMPANIES<br />

Table 5.6: Welfare impacts 1 of the ‘liberalisation’ option<br />

Baseline<br />

‘Liberalisation’ option<br />

deviation from baseline<br />

€ million € million % change<br />

Agriculture 136,353 -3,315 -2.4%<br />

Sugar industry 1,438 -1,410 -98.0%<br />

Consumers/food industry 631,234 5,713 0.9%<br />

EU budget 45,237 1,043 2.3%<br />

General welfare - 2,030 -<br />

Source: Witzke, H. P. and Kuhn, A. (2003). Assessing reform options for the Sugar Common Market Organisation -<br />

quantitative analyses with interlinked models. http://www.eurocare-bonn.de/profrec/sugar/sugar03r.<strong>pdf</strong><br />

1<br />

where welfare impacts are measured in terms of changes in activity levels, market balances and income in agriculture and<br />

in terms of estimated profit for the sugar industry. Consumer and food industry impacts are equivalent variations in<br />

percent of total <strong>final</strong> consumer expenditure. Budgetary impacts are mainly savings in export refunds.<br />

5.2. Conclusions<br />

Looking at the impact on the supply of industrial sugar for the sugar using industry, only the complete<br />

market ‘liberalisation’ option would lead to a significant and rapid change in EU sugar supply<br />

conditions. Analysis suggests that ‘liberalisation’ would lead to a reduction in EU production to<br />

around one third of present levels and the EU would become a net importer of sugar from countries<br />

with a competitive advantage for sugar production (e.g. Brazil). This would potentially have<br />

important adverse effects for the sugar-using sector, as the regularity and consistency of supply may<br />

be impacted by weather-induced production fluctuations as well as economic and political problems<br />

in these countries.<br />

Nevertheless, the complete market ‘liberalisation’ option is expected to provide industrial sugar<br />

users with the ‘lowest’ price for industrial sugar, as the internal market price would be allowed to<br />

adjust itself to the price of non-preferential imports. This would create a level playing field between<br />

the UK and both the EU and non-EU industrial users, with regard to the price of sugar. However,<br />

under the ‘liberalisation’ option, there would be a greater risk of price volatility for industrial sugar<br />

users as the market will no longer be ‘protected’.<br />

Under the ‘price reduction’ option, the UK sugar using sector will also benefit from a reduced price<br />

for industrial sugar as tariff protection would diminish and the gap between the internal EU price and<br />

the world price would close. However, unlike the ‘liberalisation’ option, the EU market would retain<br />

some protection from the volatility of industrial sugar prices on the world market.<br />

The UK industrial sugar using sector would have most protection against price volatility on the world<br />

market in the two policy options with quotas (i.e. ‘status quo’ and ‘fixed quota’ options). But this<br />

would come at a high cost to the sugar using sector. This is because the industrial sugar price will be<br />

maintained at a relatively high price level, vis-à-vis the world market price, and production quotas will<br />

limit the UK’s ability to expand production, even though it is one of the most cost competitive<br />

producers of sugar beet in the EU. With the continuation of production quotas, barriers to entry for<br />

45