2205 final report.pdf - Agra CEAS Consulting

2205 final report.pdf - Agra CEAS Consulting

2205 final report.pdf - Agra CEAS Consulting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

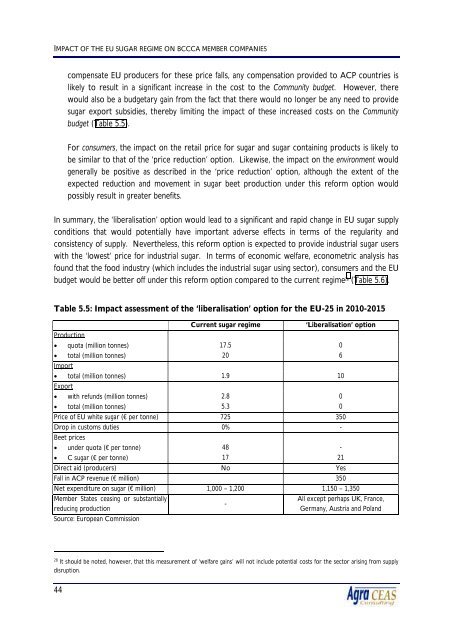

IMPACT OF THE EU SUGAR REGIME ON BCCCA MEMBER COMPANIES<br />

compensate EU producers for these price falls, any compensation provided to ACP countries is<br />

likely to result in a significant increase in the cost to the Community budget. However, there<br />

would also be a budgetary gain from the fact that there would no longer be any need to provide<br />

sugar export subsidies, thereby limiting the impact of these increased costs on the Community<br />

budget (Table 5.5).<br />

For consumers, the impact on the retail price for sugar and sugar containing products is likely to<br />

be similar to that of the ‘price reduction’ option. Likewise, the impact on the environment would<br />

generally be positive as described in the ‘price reduction’ option, although the extent of the<br />

expected reduction and movement in sugar beet production under this reform option would<br />

possibly result in greater benefits.<br />

In summary, the ‘liberalisation’ option would lead to a significant and rapid change in EU sugar supply<br />

conditions that would potentially have important adverse effects in terms of the regularity and<br />

consistency of supply. Nevertheless, this reform option is expected to provide industrial sugar users<br />

with the ‘lowest’ price for industrial sugar. In terms of economic welfare, econometric analysis has<br />

found that the food industry (which includes the industrial sugar using sector), consumers and the EU<br />

budget would be better off under this reform option compared to the current regime 28 (Table 5.6).<br />

Table 5.5: Impact assessment of the ‘liberalisation’ option for the EU-25 in 2010-2015<br />

Production<br />

Current sugar regime<br />

‘Liberalisation’ option<br />

• quota (million tonnes) 17.5 0<br />

• total (million tonnes) 20 6<br />

Import<br />

• total (million tonnes) 1.9 10<br />

Export<br />

• with refunds (million tonnes) 2.8 0<br />

• total (million tonnes) 5.3 0<br />

Price of EU white sugar (€ per tonne) 725 350<br />

Drop in customs duties 0% -<br />

Beet prices<br />

• under quota (€ per tonne) 48 -<br />

• C sugar (€ per tonne) 17 21<br />

Direct aid (producers) No Yes<br />

Fall in ACP revenue (€ million) 350<br />

Net expenditure on sugar (€ million) 1,000 – 1,200 1,150 – 1,350<br />

Member States ceasing or substantially<br />

reducing production<br />

Source: European Commission<br />

-<br />

All except perhaps UK, France,<br />

Germany, Austria and Poland<br />

28<br />

It should be noted, however, that this measurement of ‘welfare gains’ will not include potential costs for the sector arising from supply<br />

disruption.<br />

44