You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

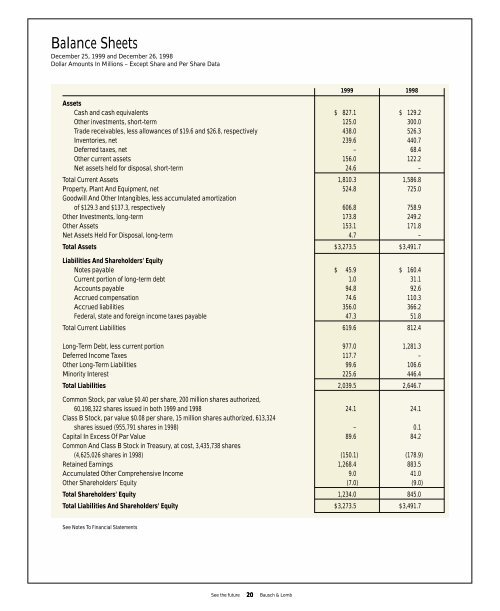

Balance Sheets<br />

December 25, <strong>1999</strong> and December 26, 1998<br />

Dollar Amounts In Millions – Except Share and Per Share Data<br />

PERCEIVE<br />

20<br />

<strong>Bausch</strong> & <strong>Lomb</strong><br />

<strong>1999</strong> 1998<br />

Assets<br />

Cash and cash equivalents $ 827.1 $ 129.2<br />

Other investments, short-term 125.0 300.0<br />

Trade receivables, less allowances of $19.6 and $26.8, respectively 438.0 526.3<br />

Inventories, net 239.6 440.7<br />

Deferred taxes, net .– 68.4<br />

Other current assets 156.0 122.2<br />

Net assets held for disposal, short-term 24.6 .–<br />

Total Current Assets 1,810.3 1,586.8<br />

Property, Plant And Equipment, net 524.8 725.0<br />

Goodwill And Other Intangibles, less accumulated amortization<br />

of $129.3 and $137.3, respectively 606.8 758.9<br />

Other Investments, long-term 173.8 249.2<br />

Other Assets 153.1 171.8<br />

Net Assets Held For Disposal, long-term 4.7 .–<br />

Total Assets $3,273.5 $3,491.7<br />

Liabilities And Shareholders’ Equity<br />

Notes payable $ 45.9 $ 160.4<br />

Current portion of long-term debt 1.0 31.1<br />

Accounts payable 94.8 92.6<br />

Accrued compensation 74.6 110.3<br />

Accrued liabilities 356.0 366.2<br />

Federal, state and foreign income taxes payable 47.3 51.8<br />

Total Current Liabilities 619.6 812.4<br />

Long-Term Debt, less current portion 977.0 1,281.3<br />

Deferred Income Taxes 117.7 .–<br />

Other Long-Term Liabilities 99.6 106.6<br />

Minority Interest 225.6 446.4<br />

Total Liabilities 2,039.5 2,646.7<br />

Common Stock, par value $0.40 per share, 200 million shares authorized,<br />

60,198,322 shares issued in both <strong>1999</strong> and 1998<br />

Class B Stock, par value $0.08 per share, 15 million shares authorized, 613,324<br />

24.1 24.1<br />

shares issued (955,791 shares in 1998) .– 0.1<br />

Capital In Excess Of Par Value<br />

Common And Class B Stock in Treasury, at cost, 3,435,738 shares<br />

89.6 84.2<br />

(4,625,026 shares in 1998) (150.1) (178.9)<br />

Retained Earnings 1,268.4 883.5<br />

Accumulated Other Comprehensive Income 9.0 41.0<br />

Other Shareholders’ Equity (7.0) (9.0)<br />

Total Shareholders’ Equity 1,234.0 845.0<br />

Total Liabilities And Shareholders’ Equity $3,273.5 $3,491.7<br />

See Notes To Financial Statements<br />

See the future