You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10. Debt<br />

Short-term debt at December 25, <strong>1999</strong> and December 26, 1998<br />

consisted of $20.9 and $101.9 in U.S. borrowings and $25.0 and<br />

$58.5 in non-U.S. borrowings, respectively. To support its liquidity<br />

requirements, the company maintains U.S. revolving credit<br />

agreements. During the second quarter of <strong>1999</strong>, the company<br />

restructured its revolving credit agreements and now maintains<br />

364-day bilateral revolving credit agreements totaling $500.0.<br />

The interest rate under these agreements is based on LIBOR, or<br />

at the company’s option, such other rate as may be agreed upon<br />

by the company and the bank. No debt was outstanding under<br />

these agreements at December 25, <strong>1999</strong>. In addition, the company<br />

maintains other lines of credit on which it may draw to meet its<br />

financing requirements. The company believes its existing credit<br />

facilities provide adequate liquidity to meet obligations, fund<br />

capital expenditures and invest in potential growth opportunities.<br />

Commitment fees on the revolving credit agreements fluctuate<br />

according to the long-term debt ratings of the company and were<br />

See the future 36 <strong>Bausch</strong> & <strong>Lomb</strong><br />

0.1% as of December 25, <strong>1999</strong>. The company also maintains<br />

unused U.S. bank lines of credit amounting to approximately<br />

$27.0. Compensating balance arrangements for these lines are<br />

not material.<br />

During <strong>1999</strong>, the company terminated two seven-year<br />

interest rate swap agreements. Each swap agreement had a<br />

notional amount of $100.0 and was used to convert $200.0 of<br />

U.S. commercial paper into fixed-rate obligations with effective<br />

interest rates, prior to termination, of 6.48%.<br />

Average short-term interest rates, which include the effect of<br />

the interest rate swap agreements in 1998, were 5.4% and 5.7%<br />

for the years ended <strong>1999</strong> and 1998, respectively. The maximum<br />

amount of short-term debt at the end of any month was $261.4<br />

in <strong>1999</strong> and $893.3 in 1998. Average short-term, month-end<br />

borrowings were $171.9 in <strong>1999</strong> and $550.1 in 1998.<br />

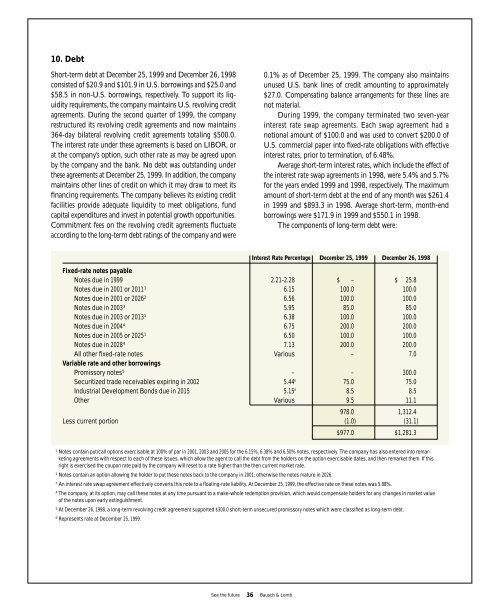

The components of long-term debt were:<br />

Interest Rate Percentage December 25, <strong>1999</strong> December 26, 1998<br />

Fixed-rate notes payable<br />

Notes due in <strong>1999</strong> 2.21-2.28 $ .– $ 25.8<br />

Notes due in 2001 or 20111 6.15 100.0 100.0<br />

Notes due in 2001 or 20262 6.56 100.0 100.0<br />

Notes due in 20033 5.95 85.0 85.0<br />

Notes due in 2003 or 20131 6.38 100.0 100.0<br />

Notes due in 20044 6.75 200.0 200.0<br />

Notes due in 2005 or 20251 6.50 100.0 100.0<br />

Notes due in 20284 7.13 200.0 200.0<br />

All other fixed-rate notes<br />

Variable rate and other borrowings<br />

Various .– 7.0<br />

Promissory notes5 – .– 300.0<br />

Securitized trade receivables expiring in 2002 5.446 75.0 75.0<br />

Industrial Development Bonds due in 2015 5.156 8.5 8.5<br />

Other Various 9.5 11.1<br />

978.0 1,312.4<br />

Less current portion (1.0) (31.1)<br />

$977.0 $1,281.3<br />

1 Notes contain put/call options exercisable at 100% of par in 2001, 2003 and 2005 for the 6.15%, 6.38% and 6.50% notes, respectively. The company has also entered into remarketing<br />

agreements with respect to each of these issues, which allow the agent to call the debt from the holders on the option exercisable dates, and then remarket them. If this<br />

right is exercised the coupon rate paid by the company will reset to a rate higher than the then current market rate.<br />

2 Notes contain an option allowing the holder to put these notes back to the company in 2001; otherwise the notes mature in 2026.<br />

3 An interest rate swap agreement effectively converts this note to a floating-rate liability. At December 25, <strong>1999</strong>, the effective rate on these notes was 5.88%.<br />

4 The company, at its option, may call these notes at any time pursuant to a make-whole redemption provision, which would compensate holders for any changes in market value<br />

of the notes upon early extinguishment.<br />

5 At December 26, 1998, a long-term revolving credit agreement supported $300.0 short-term unsecured promissory notes which were classified as long-term debt.<br />

6 Represents rate at December 25, <strong>1999</strong>.