Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Contact<br />

Lenses 62%<br />

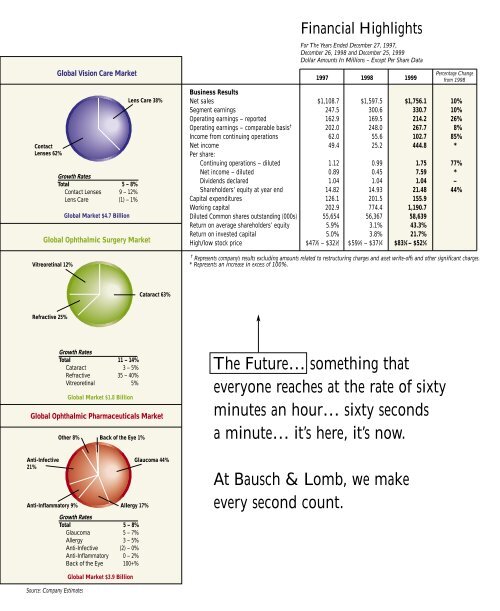

Global Vision Care Market<br />

Growth Rates<br />

Total 5 – 8%<br />

Contact Lenses 9 – 12%<br />

Lens Care (1) – 1%<br />

Global Market $4.7 Billion<br />

Lens Care 38%<br />

Global Ophthalmic Pharmaceuticals Market<br />

Anti-Infective<br />

21%<br />

Global Ophthalmic Surgery Market<br />

Vitreoretinal 12%<br />

Refractive 25%<br />

Other 8%<br />

Anti-Inflammatory 9%<br />

Source: Company Estimates<br />

Growth Rates<br />

Total 11 – 14%<br />

Cataract 3 – 5%<br />

Refractive 35 – 40%<br />

Vitreoretinal 5%<br />

Global Market $1.8 Billion<br />

Back of the Eye 1%<br />

Allergy 17%<br />

Growth Rates<br />

Total 5 – 8%<br />

Glaucoma 5 – 7%<br />

Allergy 3 – 5%<br />

Anti-Infective (2) – 0%<br />

Anti-Inflammatory 0 – 2%<br />

Back of the Eye 100+%<br />

Global Market $3.9 Billion<br />

Cataract 63%<br />

Glaucoma 44%<br />

Financial Highlights<br />

For The Years Ended December 27, 1997,<br />

December 26, 1998 and December 25, <strong>1999</strong><br />

Dollar Amounts In Millions – Except Per Share Data<br />

1997 1998 <strong>1999</strong><br />

Business Results<br />

Net sales $1,108.7 $1,597.5 $1,756.1 10%<br />

Segment earnings 247.5 300.6 330.7 10%<br />

Operating earnings – reported 162.9 169.5 214.2 26%<br />

Operating earnings – comparable basis † 202.0 248.0 267.7 8%<br />

Income from continuing operations 62.0 55.6 102.7 85%<br />

Net income 49.4 25.2 444.8 *<br />

Per share:<br />

Continuing operations – diluted 1.12 0.99 1.75 77%<br />

Net income – diluted 0.89 0.45 7.59 *<br />

Dividends declared 1.04 1.04 1.04 –<br />

Shareholders’ equity at year end 14.82 14.93 21.48 44%<br />

Capital expenditures 126.1 201.5 155.9<br />

Working capital 202.9 774.4 1,190.7<br />

Diluted Common shares outstanding (000s) 55,654 56,367 58,639<br />

Return on average shareholders’ equity 5.9% 3.1% 43.3%<br />

Return on invested capital 5.0% 3.8% 21.7%<br />

High/low stock price $47 7 ⁄8 – $32 1 ⁄2 $59 3 ⁄8 – $37 3 ⁄4 $83 3 ⁄8 – $52 5 ⁄8<br />

† Represents company’s results excluding amounts related to restructuring charges and asset write-offs and other significant charges.<br />

* Represents an increase in excess of 100%.<br />

The Future… something that<br />

everyone reaches at the rate of sixty<br />

minutes an hour… sixty seconds<br />

a minute… it’s here, it’s now.<br />

At <strong>Bausch</strong> & <strong>Lomb</strong>, we make<br />

every second count.<br />

Percentage Change<br />

from 1998