You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

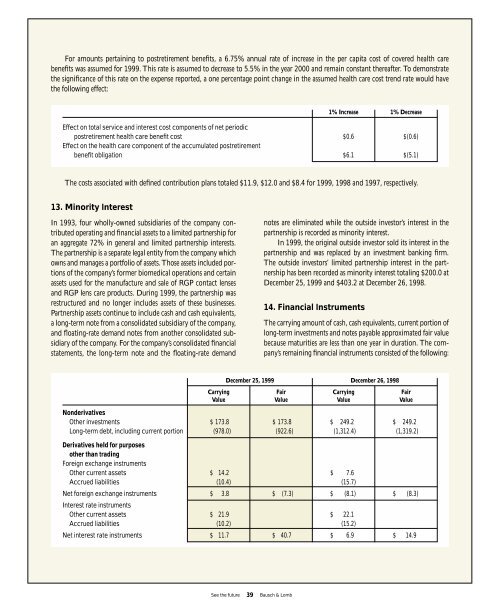

For amounts pertaining to postretirement benefits, a 6.75% annual rate of increase in the per capita cost of covered health care<br />

benefits was assumed for <strong>1999</strong>. This rate is assumed to decrease to 5.5% in the year 2000 and remain constant thereafter. To demonstrate<br />

the significance of this rate on the expense reported, a one percentage point change in the assumed health care cost trend rate would have<br />

the following effect:<br />

The costs associated with defined contribution plans totaled $11.9, $12.0 and $8.4 for <strong>1999</strong>, 1998 and 1997, respectively.<br />

13. Minority Interest<br />

In 1993, four wholly-owned subsidiaries of the company contributed<br />

operating and financial assets to a limited partnership for<br />

an aggregate 72% in general and limited partnership interests.<br />

The partnership is a separate legal entity from the company which<br />

owns and manages a portfolio of assets. Those assets included portions<br />

of the company’s former biomedical operations and certain<br />

assets used for the manufacture and sale of RGP contact lenses<br />

and RGP lens care products. During <strong>1999</strong>, the partnership was<br />

restructured and no longer includes assets of these businesses.<br />

Partnership assets continue to include cash and cash equivalents,<br />

a long-term note from a consolidated subsidiary of the company,<br />

and floating-rate demand notes from another consolidated subsidiary<br />

of the company. For the company’s consolidated financial<br />

statements, the long-term note and the floating-rate demand<br />

See the future 39 <strong>Bausch</strong> & <strong>Lomb</strong><br />

notes are eliminated while the outside investor’s interest in the<br />

partnership is recorded as minority interest.<br />

In <strong>1999</strong>, the original outside investor sold its interest in the<br />

partnership and was replaced by an investment banking firm.<br />

The outside investors’ limited partnership interest in the partnership<br />

has been recorded as minority interest totaling $200.0 at<br />

December 25, <strong>1999</strong> and $403.2 at December 26, 1998.<br />

14. Financial Instruments<br />

1% Increase 1% Decrease<br />

Effect on total service and interest cost components of net periodic<br />

postretirement health care benefit cost $0.6 $(0.6)<br />

Effect on the health care component of the accumulated postretirement<br />

benefit obligation $6.1 $(5.1)<br />

The carrying amount of cash, cash equivalents, current portion of<br />

long-term investments and notes payable approximated fair value<br />

because maturities are less than one year in duration. The company’s<br />

remaining financial instruments consisted of the following:<br />

December 25, <strong>1999</strong> December 26, 1998<br />

Carrying Fair Carrying Fair<br />

Value Value Value Value<br />

Nonderivatives<br />

Other investments $ 173.8 $ 173.8 $ 249.2 $ 249.2<br />

Long-term debt, including current portion (978.0) (922.6) (1,312.4) (1,319.2)<br />

Derivatives held for purposes<br />

other than trading<br />

Foreign exchange instruments<br />

Other current assets $ 14.2 $ 7.6<br />

Accrued liabilities (10.4) (15.7)<br />

Net foreign exchange instruments<br />

Interest rate instruments<br />

$ 3.8 $ (7.3) $ (8.1) $ (8.3)<br />

Other current assets $ 21.9 $ 22.1<br />

Accrued liabilities (10.2) (15.2)<br />

Net interest rate instruments $ 11.7 $ 40.7 $ 6.9 $ 14.9