Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

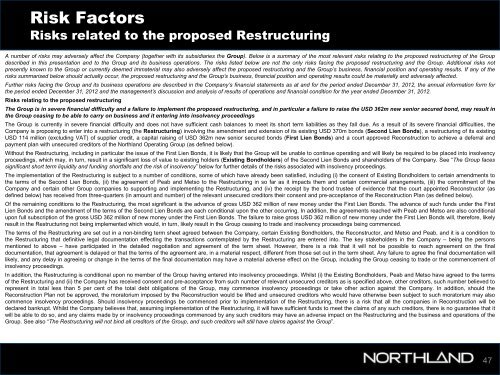

Risk Factors<br />

Risks related to the proposed Restructuring<br />

A number of risks may adversely affect the Company (together with its subsidiaries the Group). Below is a summary of the most relevant risks relating to the proposed restructuring of the Group<br />

described in this presentation and to the Group and its business operations. The risks listed below are not the only risks facing the proposed restructuring and the Group. Additional risks not<br />

presently known to the Group or currently deemed immaterial may also adversely affect the proposed restructuring and the Group’s business, financial position and operating results. If any of the<br />

risks summarised below should actually occur, the proposed restructuring and the Group’s business, financial position and operating results could be materially and adversely affected.<br />

Further risks facing the Group and its business operations are described in the Company’s financial statements as at and for the period ended December 31, 2012, the annual information form for<br />

the period ended December 31, 2012 and the management’s discussion and analysis of results of operations and financial condition for the year ended December 31, 2012.<br />

Risks relating to the proposed restructuring<br />

The Group is in severe financial difficulty and a failure to implement the proposed restructuring, and in particular a failure to raise the USD 362m new senior secured bond, may result in<br />

the Group ceasing to be able to carry on business and it entering into insolvency proceedings<br />

The Group is currently in severe financial difficulty and does not have sufficient cash balances to meet its short term liabilities as they fall due. As a result of its severe financial difficulties, the<br />

Company is proposing to enter into a restructuring (the Restructuring) involving the amendment and extension of its existing USD 370m bonds (Second Lien Bonds), a restructuring of its existing<br />

USD 114 million (excluding VAT) of supplier credit, a capital raising of USD 362m new senior secured bonds (First Lien Bonds) and a court approved Reconstruction to achieve a deferral and<br />

payment plan with unsecured creditors of the <strong>Northland</strong> Operating Group (as defined below).<br />

Without the Restructuring, including in particular the issue of the First Lien Bonds, it is likely that the Group will be unable to continue operating and will likely be required to be placed into insolvency<br />

proceedings, which may, in turn, result in a significant loss of value to existing holders (Existing Bondholders) of the Second Lien Bonds and shareholders of the Company. See “The Group faces<br />

significant short term liquidity and funding shortfalls and the risk of insolvency” below for further details of the risks associated with insolvency proceedings.<br />

The implementation of the Restructuring is subject to a number of conditions, some of which have already been satisfied, including (i) the consent of Existing Bondholders to certain amendments to<br />

the terms of the Second Lien Bonds, (ii) the agreement of Peab and Metso to the Restructuring in so far as it impacts them and certain commercial arrangements, (iii) the commitment of the<br />

Company and certain other Group companies to supporting and implementing the Restructuring, and (iv) the receipt by the bond trustee of evidence that the court appointed Reconstructor (as<br />

defined below) has received from three-quarters (in amount and number) of the relevant unsecured creditors their consent and pre-acceptance of the Reconstruction Plan (as defined below).<br />

Of the remaining conditions to the Restructuring, the most significant is the advance of gross USD 362 million of new money under the First Lien Bonds. The advance of such funds under the First<br />

Lien Bonds and the amendment of the terms of the Second Lien Bonds are each conditional upon the other occurring. In addition, the agreements reached with Peab and Metso are also conditional<br />

upon full subscription of the gross USD 362 million of new money under the First Lien Bonds. The failure to raise gross USD 362 million of new money under the First Lien Bonds will, therefore, likely<br />

result in the Restructuring not being implemented which would, in turn, likely result in the Group ceasing to trade and insolvency proceedings being commenced.<br />

The terms of the Restructuring are set out in a non-binding term sheet agreed between the Company, certain Existing Bondholders, the Reconstructor, and Metso and Peab, and it is a condition to<br />

the Restructuring that definitive legal documentation effecting the transactions contemplated by the Restructuring are entered into. The key stakeholders in the Company – being the persons<br />

mentioned to above – have participated in the detailed negotiation and agreement of the term sheet. However, there is a risk that it will not be possible to reach agreement on the final<br />

documentation, that agreement is delayed or that the terms of the agreement are, in a material respect, different from those set out in the term sheet. Any failure to agree the final documentation will<br />

likely, and any delay in agreeing or change in the terms of the final documentation may have a material adverse effect on the Group, including the Group ceasing to trade or the commencement of<br />

insolvency proceedings.<br />

In addition, the Restructuring is conditional upon no member of the Group having entered into insolvency proceedings. Whilst (i) the Existing Bondholders, Peab and Metso have agreed to the terms<br />

of the Restructuring and (ii) the Company has received consent and pre-acceptance from such number of relevant unsecured creditors as is specified above, other creditors, such number believed to<br />

represent in total less than 5 per cent of the total debt obligations of the Group, may commence insolvency proceedings or take other action against the Company. In addition, should the<br />

Reconstruction Plan not be approved, the moratorium imposed by the Reconstruction would be lifted and unsecured creditors who would have otherwise been subject to such moratorium may also<br />

commence insolvency proceedings. Should insolvency proceedings be commenced prior to implementation of the Restructuring, there is a risk that all the companies in Reconstruction will be<br />

declared bankrupt. Whilst the Company believes that, assuming implementation of the Restructuring, it will have sufficient funds to meet the claims of any such creditors, there is no guarantee that it<br />

will be able to do so, and any claims made by or insolvency proceedings commenced by any such creditors may have an adverse impact on the Restructuring and the business and operations of the<br />

Group. See also “The Restructuring will not bind all creditors of the Group, and such creditors will still have claims against the Group”.<br />

47