Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

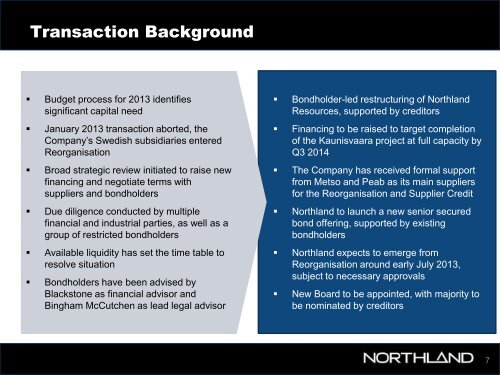

Transaction Background<br />

• Budget process for <strong>2013</strong> identifies<br />

significant capital need<br />

• January <strong>2013</strong> transaction aborted, the<br />

Company’s Swedish subsidiaries entered<br />

Reorganisation<br />

• Broad strategic review initiated to raise new<br />

financing and negotiate terms with<br />

suppliers and bondholders<br />

• Due diligence conducted by multiple<br />

financial and industrial parties, as well as a<br />

group of restricted bondholders<br />

• Available liquidity has set the time table to<br />

resolve situation<br />

• Bondholders have been advised by<br />

Blackstone as financial advisor and<br />

Bingham McCutchen as lead legal advisor<br />

• Bondholder-led restructuring of <strong>Northland</strong><br />

<strong>Resources</strong>, supported by creditors<br />

• Financing to be raised to target completion<br />

of the Kaunisvaara project at full capacity by<br />

Q3 2014<br />

• The Company has received formal support<br />

from Metso and Peab as its main suppliers<br />

for the Reorganisation and Supplier Credit<br />

• <strong>Northland</strong> to launch a new senior secured<br />

bond offering, supported by existing<br />

bondholders<br />

• <strong>Northland</strong> expects to emerge from<br />

Reorganisation around early July <strong>2013</strong>,<br />

subject to necessary approvals<br />

• New Board to be appointed, with majority to<br />

be nominated by creditors<br />

7