Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

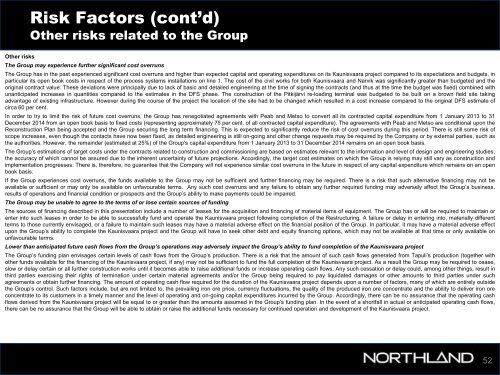

Risk Factors (cont’d)<br />

Other risks related to the Group<br />

Other risks<br />

The Group may experience further significant cost overruns<br />

The Group has in the past experienced significant cost overruns and higher than expected capital and operating expenditures on its Kaunisvaara project compared to its expectations and budgets, in<br />

particular its open book costs in respect of the process systems installations on line 1. The cost of the civil works for both Kaunisvaara and Narvik was significantly greater than budgeted and the<br />

original contract value. These deviations were principally due to lack of basic and detailed engineering at the time of signing the contracts (and thus at the time the budget was fixed) combined with<br />

unanticipated increases in quantities compared to the estimates in the DFS phase. The construction of the Pitkijärvi re-loading terminal was budgeted to be built on a brown field site taking<br />

advantage of existing infrastructure. However during the course of the project the location of the site had to be changed which resulted in a cost increase compared to the original DFS estimate of<br />

circa 60 per cent.<br />

In order to try to limit the risk of future cost overruns, the Group has renegotiated agreements with Peab and Metso to convert all its contracted capital expenditure from 1 January <strong>2013</strong> to 31<br />

December 2014 from an open book basis to fixed costs (representing approximately 75 per cent. of all contracted capital expenditure). The agreements with Peab and Metso are conditional upon the<br />

Reconstruction Plan being accepted and the Group securing the long term financing. This is expected to significantly reduce the risk of cost overruns during this period. There is still some risk of<br />

scope increases, even though the contacts have now been fixed, as detailed engineering is still on-going and other change requests may be required by the Company or by external parties, such as<br />

the authorities. However, the remainder (estimated at 25%) of the Group’s capital expenditure from 1 January <strong>2013</strong> to 31 December 2014 remains on an open book basis.<br />

The Group’s estimations of target costs under the contracts related to construction and commissioning are based on estimates relevant to the information and level of design and engineering studies,<br />

the accuracy of which cannot be assured due to the inherent uncertainty of future projections. Accordingly, the target cost estimates on which the Group is relying may still vary as construction and<br />

implementation progresses. There is, therefore, no guarantee that the Company will not experience similar cost overruns in the future in respect of any capital expenditure which remains on an open<br />

book basis.<br />

If the Group experiences cost overruns, the funds available to the Group may not be sufficient and further financing may be required. There is a risk that such alternative financing may not be<br />

available or sufficient or may only be available on unfavourable terms. Any such cost overruns and any failure to obtain any further required funding may adversely affect the Group’s business,<br />

results of operations and financial condition or prospects and the Group’s ability to make payments could be impaired.<br />

The Group may be unable to agree to the terms of or lose certain sources of funding<br />

The sources of financing described in this presentation include a number of leases for the acquisition and financing of material items of equipment. The Group has or will be required to maintain or<br />

enter into such leases in order to be able to successfully fund and operate the Kaunisvaara project following completion of the Restructuring. A failure or delay in entering into, materially different<br />

terms to those currently envisaged, or a failure to maintain such leases may have a material adverse effect on the financial position of the Group. In particular, it may have a material adverse effect<br />

upon the Group’s ability to complete the Kaunisvaara project and the Group will have to seek other debt and equity financing options, which may not be available at that time or only available on<br />

unfavourable terms.<br />

Lower than anticipated future cash flows from the Group’s operations may adversely impact the Group’s ability to fund completion of the Kaunisvaara project<br />

The Group’s funding plan envisages certain levels of cash flows from the Group’s production. There is a risk that the amount of such cash flows generated from Tapuli’s production (together with<br />

other funds available for the financing of the Kaunisvaara project, if any) may not be sufficient to fund the full completion of the Kaunisvaara project. As a result the Group may be required to cease,<br />

slow or delay certain or all further construction works until it becomes able to raise additional funds or increase operating cash flows. Any such cessation or delay could, among other things, result in<br />

third parties exercising their rights of termination under certain material agreements and/or the Group being required to pay liquidated damages or other amounts to third parties under such<br />

agreements or obtain further financing. The amount of operating cash flow required for the duration of the Kaunisvaara project depends upon a number of factors, many of which are entirely outside<br />

the Group’s control. Such factors include, but are not limited to, the prevailing iron ore price, currency fluctuations, the quality of the produced iron ore concentrate and the ability to deliver iron ore<br />

concentrate to its customers in a timely manner and the level of operating and on-going capital expenditures incurred by the Group. Accordingly, there can be no assurance that the operating cash<br />

flows derived from the Kaunisvaara project will be equal to or greater than the amounts assumed in the Group’s funding plan. In the event of a shortfall in actual or anticipated operating cash flows,<br />

there can be no assurance that the Group will be able to obtain or raise the additional funds necessary for continued operation and development of the Kaunisvaara project.<br />

52