Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

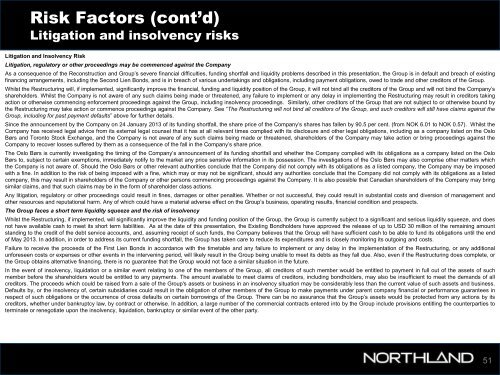

Risk Factors (cont’d)<br />

Litigation and insolvency risks<br />

Litigation and Insolvency Risk<br />

Litigation, regulatory or other proceedings may be commenced against the Company<br />

As a consequence of the Reconstruction and Group’s severe financial difficulties, funding shortfall and liquidity problems described in this presentation, the Group is in default and breach of existing<br />

financing arrangements, including the Second Lien Bonds, and is in breach of various undertakings and obligations, including payment obligations, owed to trade and other creditors of the Group.<br />

Whilst the Restructuring will, if implemented, significantly improve the financial, funding and liquidity position of the Group, it will not bind all the creditors of the Group and will not bind the Company’s<br />

shareholders. Whilst the Company is not aware of any such claims being made or threatened, any failure to implement or any delay in implementing the Restructuring may result in creditors taking<br />

action or otherwise commencing enforcement proceedings against the Group, including insolvency proceedings. Similarly, other creditors of the Group that are not subject to or otherwise bound by<br />

the Restructuring may take action or commence proceedings against the Company. See “The Restructuring will not bind all creditors of the Group, and such creditors will still have claims against the<br />

Group, including for past payment defaults” above for further details.<br />

Since the announcement by the Company on 24 January <strong>2013</strong> of its funding shortfall, the share price of the Company’s shares has fallen by 90.5 per cent. (from NOK 6.01 to NOK 0.57). Whilst the<br />

Company has received legal advice from its external legal counsel that it has at all relevant times complied with its disclosure and other legal obligations, including as a company listed on the Oslo<br />

Børs and Toronto Stock Exchange, and the Company is not aware of any such claims being made or threatened, shareholders of the Company may take action or bring proceedings against the<br />

Company to recover losses suffered by them as a consequence of the fall in the Company’s share price.<br />

The Oslo Børs is currently investigating the timing of the Company’s announcement of its funding shortfall and whether the Company complied with its obligations as a company listed on the Oslo<br />

Børs to, subject to certain exemptions, immediately notify to the market any price sensitive information in its possession. The investigations of the Oslo Børs may also comprise other matters which<br />

the Company is not aware of. Should the Oslo Børs or other relevant authorities conclude that the Company did not comply with its obligations as a listed company, the Company may be imposed<br />

with a fine. In addition to the risk of being imposed with a fine, which may or may not be significant, should any authorities conclude that the Company did not comply with its obligations as a listed<br />

company, this may result in shareholders of the Company or other persons commencing proceedings against the Company. It is also possible that Canadian shareholders of the Company may bring<br />

similar claims, and that such claims may be in the form of shareholder class actions.<br />

Any litigation, regulatory or other proceedings could result in fines, damages or other penalties. Whether or not successful, they could result in substantial costs and diversion of management and<br />

other resources and reputational harm. Any of which could have a material adverse effect on the Group’s business, operating results, financial condition and prospects.<br />

The Group faces a short term liquidity squeeze and the risk of insolvency<br />

Whilst the Restructuring, if implemented, will significantly improve the liquidity and funding position of the Group, the Group is currently subject to a significant and serious liquidity squeeze, and does<br />

not have available cash to meet its short term liabilities. As at the date of this presentation, the Existing Bondholders have approved the release of up to USD 30 million of the remaining amount<br />

standing to the credit of the debt service accounts, and, assuming receipt of such funds, the Company believes that the Group will have sufficient cash to be able to fund its obligations until the end<br />

of <strong>May</strong> <strong>2013</strong>. In addition, in order to address its current funding shortfall, the Group has taken care to reduce its expenditures and is closely monitoring its outgoing and costs.<br />

Failure to receive the proceeds of the First Lien Bonds in accordance with the timetable and any failure to implement or any delay in the implementation of the Restructuring, or any additional<br />

unforeseen costs or expenses or other events in the intervening period, will likely result in the Group being unable to meet its debts as they fall due. Also, even if the Restructuring does complete, or<br />

the Group obtains alternative financing, there is no guarantee that the Group would not face a similar situation in the future.<br />

In the event of insolvency, liquidation or a similar event relating to one of the members of the Group, all creditors of such member would be entitled to payment in full out of the assets of such<br />

member before the shareholders would be entitled to any payments. The amount available to meet claims of creditors, including bondholders, may also be insufficient to meet the demands of all<br />

creditors. The proceeds which could be raised from a sale of the Group's assets or business in an insolvency situation may be considerably less than the current value of such assets and business.<br />

Defaults by, or the insolvency of, certain subsidiaries could result in the obligation of other members of the Group to make payments under parent company financial or performance guarantees in<br />

respect of such obligations or the occurrence of cross defaults on certain borrowings of the Group. There can be no assurance that the Group’s assets would be protected from any actions by its<br />

creditors, whether under bankruptcy law, by contract or otherwise. In addition, a large number of the commercial contracts entered into by the Group include provisions entitling the counterparties to<br />

terminate or renegotiate upon the insolvency, liquidation, bankruptcy or similar event of the other party.<br />

51