Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

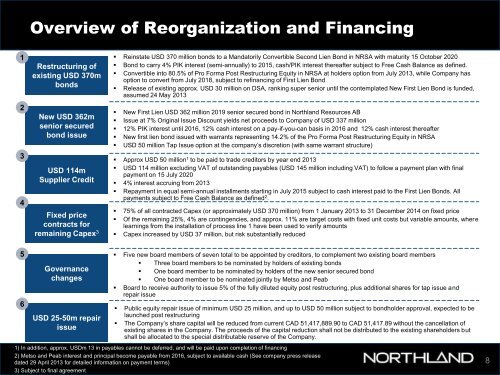

Overview of Reorganization and Financing<br />

1<br />

2<br />

3<br />

4<br />

Restructuring of<br />

existing USD 370m<br />

bonds<br />

New USD 362m<br />

senior secured<br />

bond issue<br />

USD 114m<br />

Supplier Credit<br />

Fixed price<br />

contracts for<br />

remaining Capex 3<br />

• Reinstate USD 370 million bonds to a Mandatorily Convertible Second Lien Bond in NRSA with maturity 15 October 2020<br />

• Bond to carry 4% PIK interest (semi-annually) to 2015, cash/PIK interest thereafter subject to Free Cash Balance as defined.<br />

• Convertible into 80.5% of Pro Forma Post Restructuring Equity in NRSA at holders option from July <strong>2013</strong>, while Company has<br />

option to convert from July 2018, subject to refinancing of First Lien Bond<br />

• Release of existing approx. USD 30 million on DSA, ranking super senior until the contemplated New First Lien Bond is funded,<br />

assumed 24 <strong>May</strong> <strong>2013</strong><br />

• New First Lien USD 362 million 2019 senior secured bond in <strong>Northland</strong> <strong>Resources</strong> AB<br />

• Issue at 7% Original Issue Discount yields net proceeds to Company of USD 337 million<br />

• 12% PIK interest until 2016, 12% cash interest on a pay-if-you-can basis in 2016 and 12% cash interest thereafter<br />

• New first lien bond issued with warrants representing 14.2% of the Pro Forma Post Restructuring Equity in NRSA<br />

• USD 50 million Tap Issue option at the company’s discretion (with same warrant structure)<br />

• Approx USD 50 million 1 to be paid to trade creditors by year end <strong>2013</strong><br />

• USD 114 million excluding VAT of outstanding payables (USD 145 million including VAT) to follow a payment plan with final<br />

payment on 15 July 2020<br />

• 4% interest accruing from <strong>2013</strong><br />

• Repayment in equal semi-annual installments starting in July 2015 subject to cash interest paid to the First Lien Bonds. All<br />

payments subject to Free Cash Balance as defined 2 .<br />

• 75% of all contracted Capex (or approximately USD 370 million) from 1 January <strong>2013</strong> to 31 December 2014 on fixed price<br />

• Of the remaining 25%, 4% are contingencies, and approx. 11% are target costs with fixed unit costs but variable amounts, where<br />

learnings from the installation of process line 1 have been used to verify amounts<br />

• Capex increased by USD 37 million, but risk substantially reduced<br />

5<br />

6<br />

Governance<br />

changes<br />

USD 25-50m repair<br />

issue<br />

• Five new board members of seven total to be appointed by creditors, to complement two existing board members<br />

• Three board members to be nominated by holders of existing bonds<br />

• One board member to be nominated by holders of the new senior secured bond<br />

• One board member to be nominated jointly by Metso and Peab<br />

• Board to receive authority to issue 5% of the fully diluted equity post restructuring, plus additional shares for tap issue and<br />

repair issue<br />

• Public equity repair issue of minimum USD 25 million, and up to USD 50 million subject to bondholder approval, expected to be<br />

launched post restructuring<br />

• The Company’s share capital will be reduced from current CAD 51,417,889.90 to CAD 51,417.89 without the cancellation of<br />

existing shares in the Company. The proceeds of the capital reduction shall not be distributed to the existing shareholders but<br />

shall be allocated to the special distributable reserve of the Company.<br />

1) In addition, approx. USDm 13 in payables cannot be deferred, and will be paid upon completion of financing<br />

2) Metso and Peab interest and principal become payable from 2016, subject to available cash (See company press release<br />

dated 29 April <strong>2013</strong> for detailed information on payment terms)<br />

3) Subject to final agreement<br />

8