Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

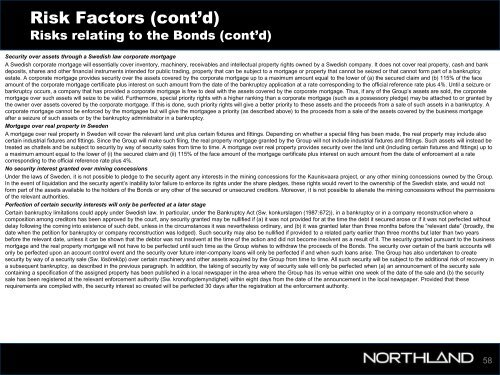

Risk Factors (cont’d)<br />

Risks relating to the Bonds (cont’d)<br />

Security over assets through a Swedish law corporate mortgage<br />

A Swedish corporate mortgage will essentially cover inventory, machinery, receivables and intellectual property rights owned by a Swedish company. It does not cover real property, cash and bank<br />

deposits, shares and other financial instruments intended for public trading, property that can be subject to a mortgage or property that cannot be seized or that cannot form part of a bankruptcy<br />

estate. A corporate mortgage provides security over the assets covered by the corporate mortgage up to a maximum amount equal to the lower of (a) the secured claim and (b) 115% of the face<br />

amount of the corporate mortgage certificate plus interest on such amount from the date of the bankruptcy application at a rate corresponding to the official reference rate plus 4%. Until a seizure or<br />

bankruptcy occurs, a company that has provided a corporate mortgage is free to deal with the assets covered by the corporate mortgage. Thus, if any of the Group’s assets are sold, the corporate<br />

mortgage over such assets will seize to be valid. Furthermore, special priority rights with a higher ranking than a corporate mortgage (such as a possessory pledge) may be attached to or granted by<br />

the owner over assets covered by the corporate mortgage. If this is done, such priority rights will give a better priority to these assets and the proceeds from a sale of such assets in a bankruptcy. A<br />

corporate mortgage cannot be enforced by the mortgagee but will give the mortgagee a priority (as described above) to the proceeds from a sale of the assets covered by the business mortgage<br />

after a seizure of such assets or by the bankruptcy administrator in a bankruptcy.<br />

Mortgage over real property in Sweden<br />

A mortgage over real property in Sweden will cover the relevant land unit plus certain fixtures and fittings. Depending on whether a special filing has been made, the real property may include also<br />

certain industrial fixtures and fittings. Since the Group will make such filing, the real property mortgage granted by the Group will not include industrial fixtures and fittings. Such assets will instead be<br />

treated as chattels and be subject to security by way of security sales from time to time. A mortgage over real property provides security over the land unit (including certain fixtures and fittings) up to<br />

a maximum amount equal to the lower of (i) the secured claim and (ii) 115% of the face amount of the mortgage certificate plus interest on such amount from the date of enforcement at a rate<br />

corresponding to the official reference rate plus 4%.<br />

No security interest granted over mining concessions<br />

Under the laws of Sweden, it is not possible to pledge to the security agent any interests in the mining concessions for the Kaunisvaara project, or any other mining concessions owned by the Group.<br />

In the event of liquidation and the security agent’s inability to/or failure to enforce its rights under the share pledges, these rights would revert to the ownership of the Swedish state, and would not<br />

form part of the assets available to the holders of the Bonds or any other of the secured or unsecured creditors. Moreover, it is not possible to alienate the mining concessions without the permissions<br />

of the relevant authorities.<br />

Perfection of certain security interests will only be perfected at a later stage<br />

Certain bankruptcy limitations could apply under Swedish law. In particular, under the Bankruptcy Act (Sw. konkurslagen (1987:672)), in a bankruptcy or in a company reconstruction where a<br />

composition among creditors has been approved by the court, any security granted may be nullified if (a) it was not provided for at the time the debt it secured arose or if it was not perfected without<br />

delay following the coming into existence of such debt, unless in the circumstances it was nevertheless ordinary, and (b) it was granted later than three months before the “relevant date” (broadly, the<br />

date when the petition for bankruptcy or company reconstruction was lodged). Such security may also be nullified if provided to a related party earlier than three months but later than two years<br />

before the relevant date, unless it can be shown that the debtor was not insolvent at the time of the action and did not become insolvent as a result of it. The security granted pursuant to the business<br />

mortgage and the real property mortgage will not have to be perfected until such time as the Group wishes to withdraw the proceeds of the Bonds. The security over certain of the bank accounts will<br />

only be perfected upon an account control event and the security over future inter-company loans will only be perfected if and when such loans arise. The Group has also undertaken to create<br />

security by way of a security sale (Sw. lösöreköp) over certain machinery and other assets acquired by the Group from time to time. All such security will be subject to the additional risk of recovery in<br />

a subsequent bankruptcy, as described in the previous paragraph. In addition, the taking of security by way of security sale will only be perfected when (a) an announcement of the security sale<br />

containing a specification of the assigned property has been published in a local newspaper in the area where the Group has its venue within one week of the date of the sale and (b) the security<br />

sale has been registered at the relevant enforcement authority (Sw. kronofogdemyndighet) within eight days from the date of the announcement in the local newspaper. Provided that these<br />

requirements are complied with, the security interest so created will be perfected 30 days after the registration at the enforcement authority.<br />

58