Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

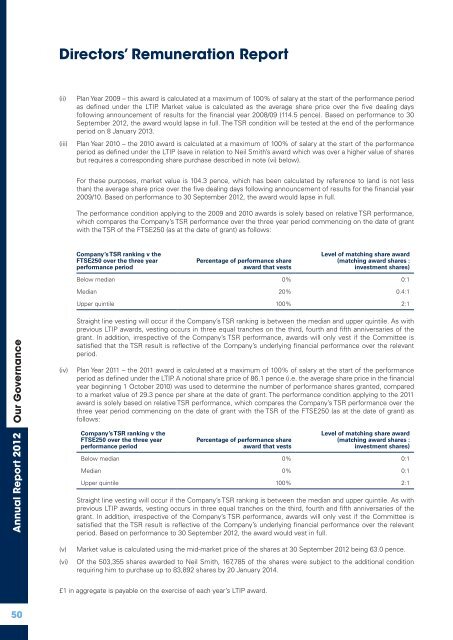

Directors’ Remuneration <strong>Report</strong><br />

(ii)<br />

(iii)<br />

Plan Year 2009 – this award is calculated at a maximum of 100% of salary at the start of the performance period<br />

as defined under the LTIP. Market value is calculated as the average share price over the five dealing days<br />

following announcement of results for the financial year 2008/09 (114.5 pence). Based on performance to 30<br />

September <strong>2012</strong>, the award would lapse in full. The TSR condition will be tested at the end of the performance<br />

period on 8 January 2013.<br />

Plan Year 2010 – the 2010 award is calculated at a maximum of 100% of salary at the start of the performance<br />

period as defined under the LTIP (save in relation to Neil Smith’s award which was over a higher value of shares<br />

but requires a corresponding share purchase described in note (vi) below).<br />

For these purposes, market value is 104.3 pence, which has been calculated by reference to (<strong>and</strong> is not less<br />

than) the average share price over the five dealing days following announcement of results for the financial year<br />

2009/10. Based on performance to 30 September <strong>2012</strong>, the award would lapse in full.<br />

The performance condition applying to the 2009 <strong>and</strong> 2010 awards is solely based on relative TSR performance,<br />

which compares the Company’s TSR performance over the three year period commencing on the date of grant<br />

with the TSR of the FTSE250 (as at the date of grant) as follows:<br />

Company’s TSR ranking v the<br />

FTSE250 over the three year<br />

performance period<br />

Percentage of performance share<br />

award that vests<br />

Level of matching share award<br />

(matching award shares :<br />

investment shares)<br />

Below median 0% 0:1<br />

Median 20% 0.4:1<br />

Upper quintile 100% 2:1<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> Our Governance<br />

(iv)<br />

Straight line vesting will occur if the Company’s TSR ranking is between the median <strong>and</strong> upper quintile. As with<br />

previous LTIP awards, vesting occurs in three equal tranches on the third, fourth <strong>and</strong> fifth anniversaries of the<br />

grant. In addition, irrespective of the Company’s TSR performance, awards will only vest if the Committee is<br />

satisfied that the TSR result is reflective of the Company’s underlying financial performance over the relevant<br />

period.<br />

Plan Year 2011 – the 2011 award is calculated at a maximum of 100% of salary at the start of the performance<br />

period as defined under the LTIP. A notional share price of 86.1 pence (i.e. the average share price in the financial<br />

year beginning 1 October 2010) was used to determine the number of performance shares granted, compared<br />

to a market value of 29.3 pence per share at the date of grant. The performance condition applying to the 2011<br />

award is solely based on relative TSR performance, which compares the Company’s TSR performance over the<br />

three year period commencing on the date of grant with the TSR of the FTSE250 (as at the date of grant) as<br />

follows:<br />

Company’s TSR ranking v the<br />

FTSE250 over the three year<br />

performance period<br />

Percentage of performance share<br />

award that vests<br />

Level of matching share award<br />

(matching award shares :<br />

investment shares)<br />

Below median 0% 0:1<br />

Median 0% 0:1<br />

Upper quintile 100% 2:1<br />

Straight line vesting will occur if the Company’s TSR ranking is between the median <strong>and</strong> upper quintile. As with<br />

previous LTIP awards, vesting occurs in three equal tranches on the third, fourth <strong>and</strong> fifth anniversaries of the<br />

grant. In addition, irrespective of the Company’s TSR performance, awards will only vest if the Committee is<br />

satisfied that the TSR result is reflective of the Company’s underlying financial performance over the relevant<br />

period. Based on performance to 30 September <strong>2012</strong>, the award would vest in full.<br />

(v)<br />

(vi)<br />

Market value is calculated using the mid-market price of the shares at 30 September <strong>2012</strong> being 63.0 pence.<br />

Of the 503,355 shares awarded to Neil Smith, 167,785 of the shares were subject to the additional condition<br />

requiring him to purchase up to 83,892 shares by 20 January 2014.<br />

£1 in aggregate is payable on the exercise of each year’s LTIP award.<br />

50