Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Accounts</strong><br />

at 30 September <strong>2012</strong><br />

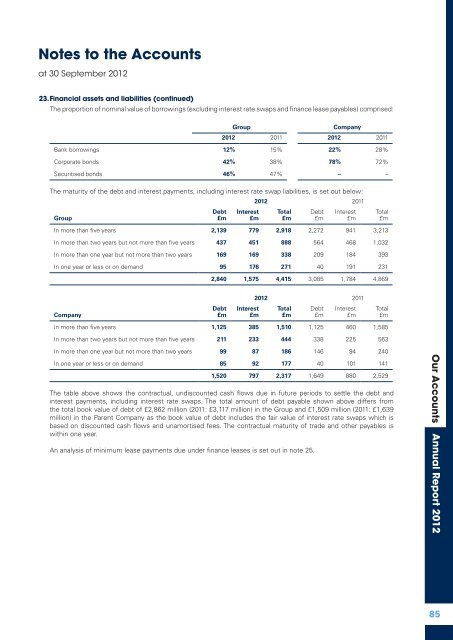

23. Financial assets <strong>and</strong> liabilities (continued)<br />

The proportion of nominal value of borrowings (excluding interest rate swaps <strong>and</strong> finance lease payables) comprised:<br />

Group<br />

Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Bank borrowings 12% 15% 22% 28%<br />

Corporate bonds 42% 38% 78% 72%<br />

Securitised bonds 46% 47% – –<br />

The maturity of the debt <strong>and</strong> interest payments, including interest rate swap liabilities, is set out below:<br />

Group<br />

Debt<br />

£m<br />

Interest<br />

£m<br />

<strong>2012</strong> 2011<br />

Total<br />

£m<br />

Debt<br />

£m<br />

Interest<br />

£m<br />

Total<br />

£m<br />

In more than five years 2,139 779 2,918 2,272 941 3,213<br />

In more than two years but not more than five years 437 451 888 564 468 1,032<br />

In more than one year but not more than two years 169 169 338 209 184 393<br />

In one year or less or on dem<strong>and</strong> 95 176 271 40 191 231<br />

2,840 1,575 4,415 3,085 1,784 4,869<br />

<strong>2012</strong> 2011<br />

Company<br />

Debt<br />

£m<br />

Interest<br />

£m<br />

Total<br />

£m<br />

Debt<br />

£m<br />

Interest<br />

£m<br />

Total<br />

£m<br />

In more than five years 1,125 385 1,510 1,125 460 1,585<br />

In more than two years but not more than five years 211 233 444 338 225 563<br />

In more than one year but not more than two years 99 87 186 146 94 240<br />

In one year or less or on dem<strong>and</strong> 85 92 177 40 101 141<br />

1,520 797 2,317 1,649 880 2,529<br />

The table above shows the contractual, undiscounted cash flows due in future periods to settle the debt <strong>and</strong><br />

interest payments, including interest rate swaps. The total amount of debt payable shown above differs from<br />

the total book value of debt of £2,862 million (2011: £3,117 million) in the Group <strong>and</strong> £1,509 million (2011: £1,639<br />

million) in the Parent Company as the book value of debt includes the fair value of interest rate swaps which is<br />

based on discounted cash flows <strong>and</strong> unamortised fees. The contractual maturity of trade <strong>and</strong> other payables is<br />

within one year.<br />

An analysis of minimum lease payments due under finance leases is set out in note 25.<br />

Our <strong>Accounts</strong> <strong>Annual</strong> <strong>Report</strong> 2011 <strong>2012</strong><br />

85