Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the <strong>Accounts</strong><br />

at 30 September <strong>2012</strong><br />

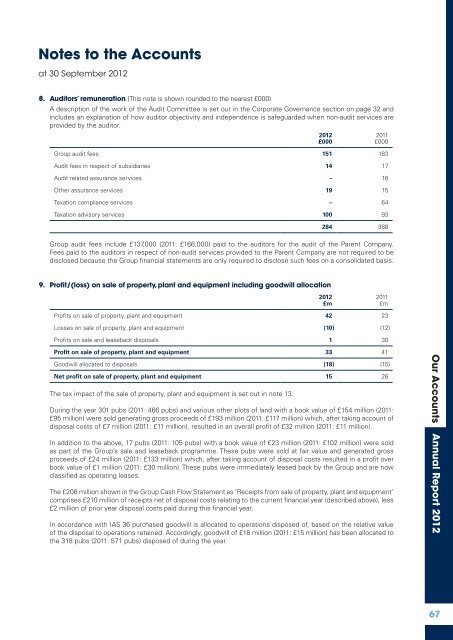

8. Auditors’ remuneration (This note is shown rounded to the nearest £000)<br />

A description of the work of the Audit Committee is set out in the Corporate Governance section on page 32 <strong>and</strong><br />

includes an explanation of how auditor objectivity <strong>and</strong> independence is safeguarded when non-audit services are<br />

provided by the auditor.<br />

<strong>2012</strong><br />

£000<br />

Group audit fees 151 183<br />

Audit fees in respect of subsidiaries 14 17<br />

Audit related assurance services – 16<br />

Other assurance services 19 15<br />

Taxation compliance services – 64<br />

Taxation advisory services 100 93<br />

2011<br />

£000<br />

284 388<br />

Group audit fees include £137,000 (2011: £166,000) paid to the auditors for the audit of the Parent Company.<br />

Fees paid to the auditors in respect of non-audit services provided to the Parent Company are not required to be<br />

disclosed because the Group financial statements are only required to disclose such fees on a consolidated basis.<br />

9. Profit/(loss) on sale of property, plant <strong>and</strong> equipment including goodwill allocation<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Profits on sale of property, plant <strong>and</strong> equipment 42 23<br />

Losses on sale of property, plant <strong>and</strong> equipment (10) (12)<br />

Profits on sale <strong>and</strong> leaseback disposals 1 30<br />

Profit on sale of property, plant <strong>and</strong> equipment 33 41<br />

Goodwill allocated to disposals (18) (15)<br />

Net profit on sale of property, plant <strong>and</strong> equipment 15 26<br />

The tax impact of the sale of property, plant <strong>and</strong> equipment is set out in note 13.<br />

During the year 301 pubs (2011: 466 pubs) <strong>and</strong> various other plots of l<strong>and</strong> with a book value of £154 million (2011:<br />

£95 million) were sold generating gross proceeds of £193 million (2011: £117 million) which, after taking account of<br />

disposal costs of £7 million (2011: £11 million), resulted in an overall profit of £32 million (2011: £11 million).<br />

In addition to the above, 17 pubs (2011: 105 pubs) with a book value of £23 million (2011: £102 million) were sold<br />

as part of the Group’s sale <strong>and</strong> leaseback programme. These pubs were sold at fair value <strong>and</strong> generated gross<br />

proceeds of £24 million (2011: £133 million) which, after taking account of disposal costs resulted in a profit over<br />

book value of £1 million (2011: £30 million). These pubs were immediately leased back by the Group <strong>and</strong> are now<br />

classified as operating leases.<br />

The £208 million shown in the Group Cash Flow Statement as ‘Receipts from sale of property, plant <strong>and</strong> equipment’<br />

comprises £210 million of receipts net of disposal costs relating to the current financial year (described above), less<br />

£2 million of prior year disposal costs paid during this financial year.<br />

In accordance with IAS 36 purchased goodwill is allocated to operations disposed of, based on the relative value<br />

of the disposal to operations retained. Accordingly, goodwill of £18 million (2011: £15 million) has been allocated to<br />

the 318 pubs (2011: 571 pubs) disposed of during the year.<br />

Our <strong>Accounts</strong> <strong>Annual</strong> <strong>Report</strong> 2011 <strong>2012</strong><br />

67