Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

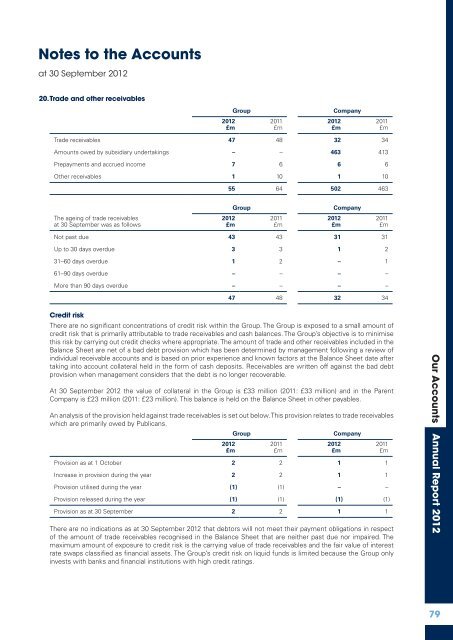

Notes to the <strong>Accounts</strong><br />

at 30 September <strong>2012</strong><br />

20. Trade <strong>and</strong> other receivables<br />

Group<br />

Company<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Trade receivables 47 48 32 34<br />

Amounts owed by subsidiary undertakings – – 463 413<br />

Prepayments <strong>and</strong> accrued income 7 6 6 6<br />

Other receivables 1 10 1 10<br />

55 64 502 463<br />

Group<br />

Company<br />

The ageing of trade receivables<br />

at 30 September was as follows<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Not past due 43 43 31 31<br />

Up to 30 days overdue 3 3 1 2<br />

31–60 days overdue 1 2 – 1<br />

61–90 days overdue – – – –<br />

More than 90 days overdue – – – –<br />

47 48 32 34<br />

Credit risk<br />

There are no significant concentrations of credit risk within the Group. The Group is exposed to a small amount of<br />

credit risk that is primarily attributable to trade receivables <strong>and</strong> cash balances. The Group’s objective is to minimise<br />

this risk by carrying out credit checks where appropriate. The amount of trade <strong>and</strong> other receivables included in the<br />

Balance Sheet are net of a bad debt provision which has been determined by management following a review of<br />

individual receivable accounts <strong>and</strong> is based on prior experience <strong>and</strong> known factors at the Balance Sheet date after<br />

taking into account collateral held in the form of cash deposits. Receivables are written off against the bad debt<br />

provision when management considers that the debt is no longer recoverable.<br />

At 30 September <strong>2012</strong> the value of collateral in the Group is £33 million (2011: £33 million) <strong>and</strong> in the Parent<br />

Company is £23 million (2011: £23 million). This balance is held on the Balance Sheet in other payables.<br />

An analysis of the provision held against trade receivables is set out below. This provision relates to trade receivables<br />

which are primarily owed by Publicans.<br />

<strong>2012</strong><br />

£m<br />

Group<br />

2011<br />

£m<br />

Company<br />

Provision as at 1 October 2 2 1 1<br />

Increase in provision during the year 2 2 1 1<br />

Provision utilised during the year (1) (1) – –<br />

Provision released during the year (1) (1) (1) (1)<br />

Provision as at 30 September 2 2 1 1<br />

There are no indications as at 30 September <strong>2012</strong> that debtors will not meet their payment obligations in respect<br />

of the amount of trade receivables recognised in the Balance Sheet that are neither past due nor impaired. The<br />

maximum amount of exposure to credit risk is the carrying value of trade receivables <strong>and</strong> the fair value of interest<br />

rate swaps classified as financial assets. The Group’s credit risk on liquid funds is limited because the Group only<br />

invests with banks <strong>and</strong> financial institutions with high credit ratings.<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Our <strong>Accounts</strong> <strong>Annual</strong> <strong>Report</strong> 2011 <strong>2012</strong><br />

79