Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Enterprise Inns plc Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

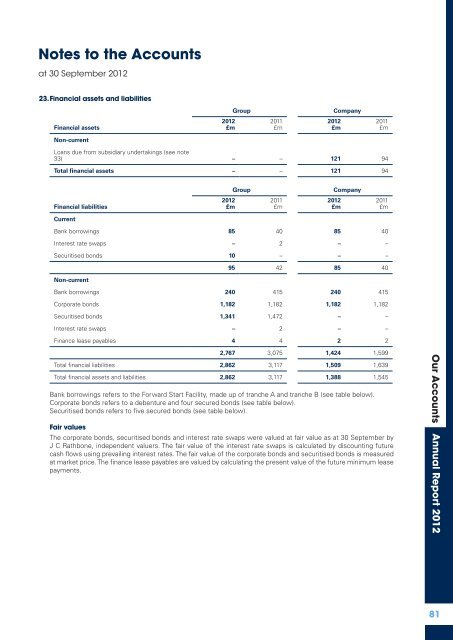

Notes to the <strong>Accounts</strong><br />

at 30 September <strong>2012</strong><br />

23. Financial assets <strong>and</strong> liabilities<br />

Group<br />

Company<br />

Financial assets<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Non-current<br />

Loans due from subsidiary undertakings (see note<br />

33) – – 121 94<br />

Total financial assets – – 121 94<br />

Group<br />

Company<br />

Financial liabilities<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Current<br />

Bank borrowings 85 40 85 40<br />

Interest rate swaps – 2 – –<br />

Securitised bonds 10 – – –<br />

95 42 85 40<br />

Non-current<br />

Bank borrowings 240 415 240 415<br />

Corporate bonds 1,182 1,182 1,182 1,182<br />

Securitised bonds 1,341 1,472 – –<br />

Interest rate swaps – 2 – –<br />

Finance lease payables 4 4 2 2<br />

2,767 3,075 1,424 1,599<br />

Total financial liabilities 2,862 3,117 1,509 1,639<br />

Total financial assets <strong>and</strong> liabilities 2,862 3,117 1,388 1,545<br />

Bank borrowings refers to the Forward Start Facility, made up of tranche A <strong>and</strong> tranche B (see table below).<br />

Corporate bonds refers to a debenture <strong>and</strong> four secured bonds (see table below).<br />

Securitised bonds refers to five secured bonds (see table below).<br />

Fair values<br />

The corporate bonds, securitised bonds <strong>and</strong> interest rate swaps were valued at fair value as at 30 September by<br />

J C Rathbone, independent valuers. The fair value of the interest rate swaps is calculated by discounting future<br />

cash flows using prevailing interest rates. The fair value of the corporate bonds <strong>and</strong> securitised bonds is measured<br />

at market price. The finance lease payables are valued by calculating the present value of the future minimum lease<br />

payments.<br />

Our <strong>Accounts</strong> <strong>Annual</strong> <strong>Report</strong> 2011 <strong>2012</strong><br />

81