Annual Report 2012-2013 - UB Group

Annual Report 2012-2013 - UB Group

Annual Report 2012-2013 - UB Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

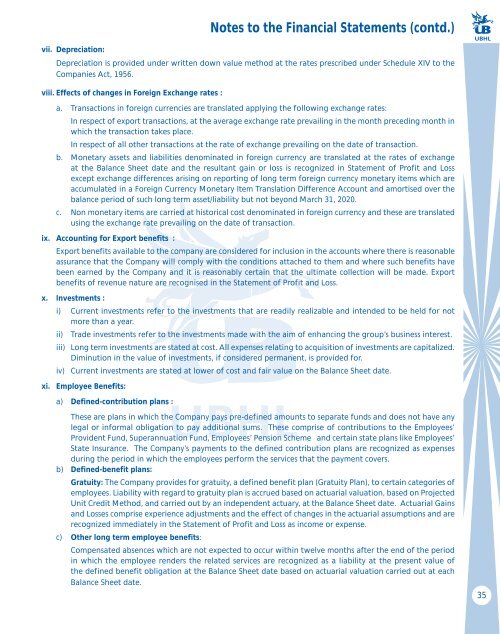

vii. Depreciation:<br />

Notes to the Financial Statements (contd.)<br />

Depreciation is provided under written down value method at the rates prescribed under Schedule XIV to the<br />

Companies Act, 1956.<br />

viii. Effects of changes in Foreign Exchange rates :<br />

a. Transactions in foreign currencies are translated applying the following exchange rates:<br />

In respect of export transactions, at the average exchange rate prevailing in the month preceding month in<br />

which the transaction takes place.<br />

In respect of all other transactions at the rate of exchange prevailing on the date of transaction.<br />

b. Monetary assets and liabilities denominated in foreign currency are translated at the rates of exchange<br />

at the Balance Sheet date and the resultant gain or loss is recognized in Statement of Profit and Loss<br />

except exchange differences arising on reporting of long term foreign currency monetary items which are<br />

accumulated in a Foreign Currency Monetary Item Translation Difference Account and amortised over the<br />

balance period of such long term asset/liability but not beyond March 31, 2020.<br />

c. Non monetary items are carried at historical cost denominated in foreign currency and these are translated<br />

using the exchange rate prevailing on the date of transaction.<br />

ix. Accounting for Export benefits :<br />

Export benefits available to the company are considered for inclusion in the accounts where there is reasonable<br />

assurance that the Company will comply with the conditions attached to them and where such benefits have<br />

been earned by the Company and it is reasonably certain that the ultimate collection will be made. Export<br />

benefits of revenue nature are recognised in the Statement of Profit and Loss.<br />

x. Investments :<br />

i) Current investments refer to the investments that are readily realizable and intended to be held for not<br />

more than a year.<br />

ii) Trade investments refer to the investments made with the aim of enhancing the group’s business interest.<br />

iii) Long term investments are stated at cost. All expenses relating to acquisition of investments are capitalized.<br />

Diminution in the value of investments, if considered permanent, is provided for.<br />

iv) Current investments are stated at lower of cost and fair value on the Balance Sheet date.<br />

xi. Employee Benefits:<br />

a) Defined-contribution plans :<br />

These are plans in which the Company pays pre-defined amounts to separate funds and does not have any<br />

legal or informal obligation to pay additional sums. These comprise of contributions to the Employees’<br />

Provident Fund, Superannuation Fund, Employees’ Pension Scheme and certain state plans like Employees’<br />

State Insurance. The Company’s payments to the defined contribution plans are recognized as expenses<br />

during the period in which the employees perform the services that the payment covers.<br />

b) Defined-benefit plans:<br />

Gratuity: The Company provides for gratuity, a defined benefit plan (Gratuity Plan), to certain categories of<br />

employees. Liability with regard to gratuity plan is accrued based on actuarial valuation, based on Projected<br />

Unit Credit Method, and carried out by an independent actuary, at the Balance Sheet date. Actuarial Gains<br />

and Losses comprise experience adjustments and the effect of changes in the actuarial assumptions and are<br />

recognized immediately in the Statement of Profit and Loss as income or expense.<br />

c) Other long term employee benefits:<br />

Compensated absences which are not expected to occur within twelve months after the end of the period<br />

in which the employee renders the related services are recognized as a liability at the present value of<br />

the defined benefit obligation at the Balance Sheet date based on actuarial valuation carried out at each<br />

Balance Sheet date.<br />

35