Annual Report 2012-2013 - UB Group

Annual Report 2012-2013 - UB Group

Annual Report 2012-2013 - UB Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements (contd.)<br />

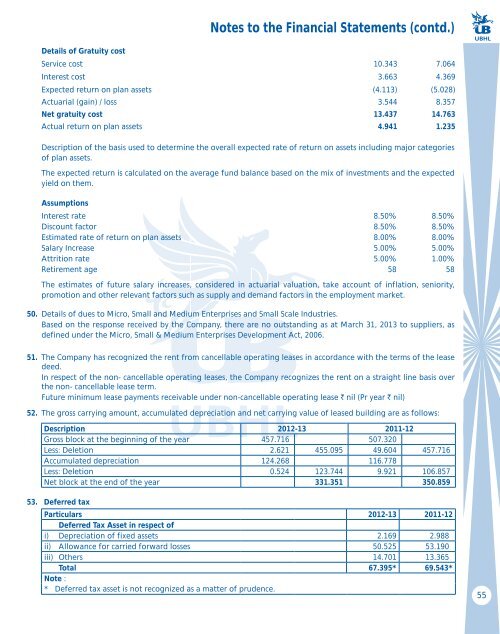

Details of Gratuity cost<br />

Service cost 10.343 7.064<br />

Interest cost 3.663 4.369<br />

Expected return on plan assets (4.113) (5.028)<br />

Actuarial (gain) / loss 3.544 8.357<br />

Net gratuity cost 13.437 14.763<br />

Actual return on plan assets 4.941 1.235<br />

Description of the basis used to determine the overall expected rate of return on assets including major categories<br />

of plan assets.<br />

The expected return is calculated on the average fund balance based on the mix of investments and the expected<br />

yield on them.<br />

Assumptions<br />

Interest rate 8.50% 8.50%<br />

Discount factor 8.50% 8.50%<br />

Estimated rate of return on plan assets 8.00% 8.00%<br />

Salary Increase 5.00% 5.00%<br />

Attrition rate 5.00% 1.00%<br />

Retirement age 58 58<br />

The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority,<br />

promotion and other relevant factors such as supply and demand factors in the employment market.<br />

50. Details of dues to Micro, Small and Medium Enterprises and Small Scale Industries.<br />

Based on the response received by the Company, there are no outstanding as at March 31, <strong>2013</strong> to suppliers, as<br />

defined under the Micro, Small & Medium Enterprises Development Act, 2006.<br />

51. The Company has recognized the rent from cancellable operating leases in accordance with the terms of the lease<br />

deed.<br />

In respect of the non- cancellable operating leases, the Company recognizes the rent on a straight line basis over<br />

the non- cancellable lease term.<br />

Future minimum lease payments receivable under non-cancellable operating lease ` nil (Pr year ` nil)<br />

52. The gross carrying amount, accumulated depreciation and net carrying value of leased building are as follows:<br />

Description <strong>2012</strong>-13 2011-12<br />

Gross block at the beginning of the year 457.716 507.320<br />

Less: Deletion 2.621 455.095 49.604 457.716<br />

Accumulated depreciation 124.268 116.778<br />

Less: Deletion 0.524 123.744 9.921 106.857<br />

Net block at the end of the year 331.351 350.859<br />

53. Deferred tax<br />

Particulars <strong>2012</strong>-13 2011-12<br />

Deferred Tax Asset in respect of<br />

i) Depreciation of fixed assets 2.169 2.988<br />

ii) Allowance for carried forward losses 50.525 53.190<br />

iii) Others 14.701 13.365<br />

Total 67.395* 69.543*<br />

Note :<br />

* Deferred tax asset is not recognized as a matter of prudence.<br />

55