ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Comments on the balance sheet<br />

The balance sheet total declined by about 16<br />

percent to SEK 78.4 billion (93.1).<br />

The balance sheet total was affected substantially<br />

by writedowns of acquisition goodwill<br />

and lower business volume. In addition,<br />

the balance sheet total declined by about SEK<br />

6.5 billion due to translation from foreign currencies<br />

to Swedish kronor.<br />

Assets<br />

Intangible fixed assets<br />

Intangible fixed assets declined to SEK 6.1 billion<br />

(8.5).<br />

“Intangible fixed assets” consisted of SEK<br />

5.6 billion in goodwill and SEK 0.5 billion in<br />

other intangible assets.<br />

Goodwill amounted to SEK 5.6 billion<br />

(7.7), a decline of SEK 2.1 billion.<br />

The goodwill amount was affected by the<br />

year’s SEK 1.7 billion in acquisition goodwill<br />

writedowns and SEK 0.6 billion in amortization.<br />

Through acquisitions, the goodwill item<br />

rose by SEK 0.2 billion, mainly through the<br />

acquisition of Yeager. Translation differences<br />

when converting currencies lowered the goodwill<br />

item by SEK 0.2 billion, while other adjustments<br />

increased the item by SEK 0.2 billion.<br />

Other intangible fixed assets fell by SEK 0.3 billion<br />

to SEK 0.5 billion (0.8). The decline was<br />

due to currency translation differences and<br />

writedowns. The item consisted mainly of a<br />

concession to operate a toll highway in a BOT<br />

project in Chile.<br />

Tangible fixed assets<br />

Tangible fixed assets fell by SEK 12.6 billion to<br />

SEK 8.1 billion (20.7).<br />

The decline was mainly attributable to the<br />

reclassification of properties in real estate operations<br />

from fixed assets to current assets.<br />

Other buildings and land<br />

“Other buildings and land” included business<br />

properties used in the Group’s own operations,<br />

mainly warehouses, production plants, gravel<br />

pits and Group offices.<br />

Acquisition premiums in properties in Polish<br />

operations were written down by SEK 150<br />

M during the year.<br />

Financial fixed assets<br />

Investments in associated companies in BOT<br />

operations in Chile and Brazil increased holdings<br />

of shares and participations in associated<br />

companies and joint ventures. The holding in<br />

Pandox and one third of the holding in Nobia<br />

were sold during the year, which decreased the<br />

item “Other long-term holdings of securities.”<br />

“Other long-term receivables” consisted largely<br />

of deferred tax claims.<br />

Current-asset properties<br />

<strong>Skanska</strong> previously reported only those properties<br />

that were intended to be sold in conjunction<br />

with contracting projects as “Current-asset<br />

properties.” Due to the strategic shift toward<br />

faster turnover in property holdings, properties<br />

that belong to real estate operations are now<br />

also reported as current-asset properties.<br />

Among other things, this means that no depreciation<br />

is carried out. If previous accounting<br />

principles had been in force, depreciation<br />

would have totaled more than SEK 200 M.<br />

Due to changes in accounting principles,<br />

interest expenses of about SEK 100 M were<br />

capitalized.<br />

Book value of properties<br />

in real estate operations<br />

SEK M <strong>2002</strong> 2001<br />

Completed properties 7,227 4,744<br />

Properties under construction 3,449 5,018<br />

Development properties 1,934 2,229<br />

12,610 11,991<br />

The book value of properties in real estate<br />

operations rose from SEK 12.0 billion to SEK<br />

12.6 billion. The increase in book value was<br />

attributable to a lower volume of completed<br />

divestments.<br />

Book value of “Other current-asset properties”<br />

(project development for <strong>Skanska</strong>’s own account)<br />

SEK M <strong>2002</strong> 2001<br />

Scandinavia 4,029 3,652<br />

Europe 1,850 2,123<br />

United States 988 900<br />

Other markets 67 124<br />

Total 6,934 6,799<br />

Other current-asset properties, which comprise<br />

construction for <strong>Skanska</strong>’s own account<br />

in contracting operations, were stable during<br />

the year. Investments totaled about SEK 5.2<br />

billion and properties with a book value of<br />

about SEK 5.0 billion were sold. Writedowns<br />

in book values of “Other current-asset properties”<br />

in the Baltic countries and Denmark<br />

totaled about SEK 0.1 billion.<br />

Current receivables<br />

Current receivables fell by about 23 percent<br />

compared to 2001. The decline was largely<br />

related to lower business volume and completion<br />

of projects with invoicing deficits in relation<br />

to accrued revenue, plus the fact that payment<br />

of receivables for property sales in the<br />

previous year was settled. Currency translation<br />

differences accounted for about SEK 3.7 billion<br />

of the decline.<br />

Liabilities and shareholders’ equity<br />

Shareholders’ equity<br />

Shareholders’ equity amounted to SEK 14.2 billion,<br />

of which SEK 11.5 billion consisted of<br />

unrestricted and SEK 2.7 billion of restricted<br />

equity. During the year, SEK 1.3 billion was distributed<br />

to the shareholders. Currency translation<br />

differences lowered shareholders’ equity by<br />

about SEK 1.5 billion. Given the large proportion<br />

of shareholders’ equity denominated in<br />

American dollars, in September <strong>2002</strong> the Group<br />

currency hedged the shareholders’ equity in its<br />

U.S. subsidiaries.<br />

Provisions<br />

Provisions rose by about SEK 1 billion to SEK<br />

6.4 billion.<br />

“Provisions for pensions” rose by about<br />

SEK 0.5 billion. Of the increase, SEK 0.4 billion<br />

was attributable to obligations in Swedish<br />

pension funds.<br />

“Other provisions” totaled SEK 3.1 billion.<br />

The increase of SEK 0.4 billion was largely<br />

explained by increased provisions for restructuring<br />

measures.<br />

Liabilities<br />

The item “liabilities” decreased by about SEK<br />

11.8 billion to SEK 57.5 billion (69.3).<br />

Interest-bearing liabilities declined by<br />

about SEK 1.4 billion to SEK 16.4 billion,<br />

while non-interest-bearing liabilities fell by<br />

SEK 10.4 billion.<br />

The change in non-interest-bearing liabilities<br />

was attributable to the decline in business<br />

volume, such as a decreased surplus in invoiced<br />

sales compared to accrued revenues for uncompleted<br />

contracts as well as a decline in accounts<br />

payable. Tax liabilities fell by about SEK 1 billion,<br />

mainly because <strong>Skanska</strong> made the final<br />

payments on taxes related to tax disputes concerning<br />

aircraft leasing.<br />

Impact of currencies<br />

on the balance sheet<br />

Translation differences when converting foreign<br />

currencies to Swedish kronor affected the balance<br />

sheet as shown in the following table.<br />

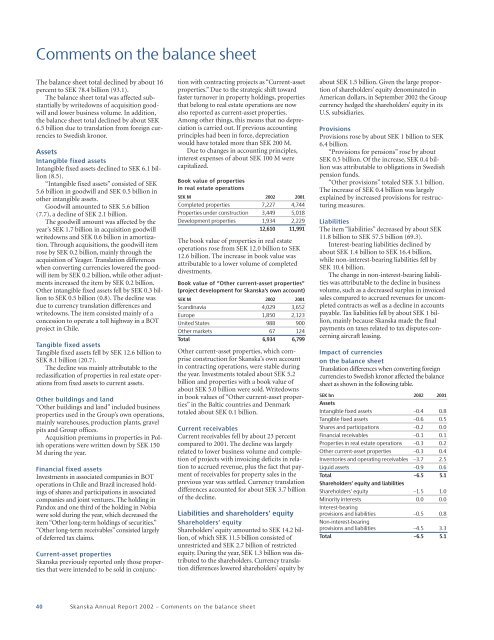

SEK bn <strong>2002</strong> 2001<br />

Assets<br />

Intangible fixed assets –0.4 0.8<br />

Tangible fixed assets –0.6 0.5<br />

Shares and participations –0.2 0.0<br />

Financial receivables –0.10.1<br />

Properties in real estate operations –0.3 0.2<br />

Other current-asset properties –0.3 0.4<br />

Inventories and operating receivables –3.7 2.5<br />

Liquid assets –0.9 0.6<br />

Total –6.5 5.1<br />

Shareholders’ equity and liabilities<br />

Shareholders’ equity –1.5 1.0<br />

Minority interests 0.0 0.0<br />

Interest-bearing<br />

provisions and liabilities –0.5 0.8<br />

Non-interest-bearing<br />

provisions and liabilities –4.5 3.3<br />

Total –6.5 5.1<br />

40 <strong>Skanska</strong> Annual Report <strong>2002</strong> – Comments on the balance sheet