ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 12 continued<br />

Note 13<br />

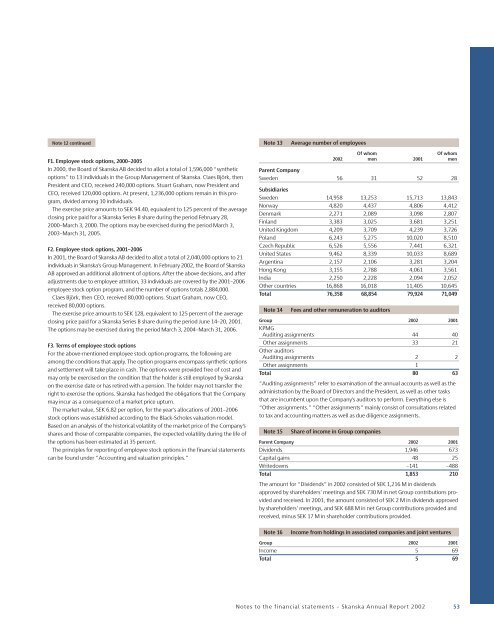

Average number of employees<br />

F1. Employee stock options, 2000–2005<br />

In 2000, the Board of <strong>Skanska</strong> AB decided to allot a total of 1,596,000 “synthetic<br />

options” to 13 individuals in the Group Management of <strong>Skanska</strong>. Claes Björk, then<br />

President and CEO, received 240,000 options. Stuart Graham, now President and<br />

CEO, received 120,000 options. At present, 1,236,000 options remain in this program,<br />

divided among 10 individuals.<br />

The exercise price amounts to SEK 94.40, equivalent to 125 percent of the average<br />

closing price paid for a <strong>Skanska</strong> Series B share during the period February 28,<br />

2000–March 3, 2000. The options may be exercised during the period March 3,<br />

2003–March 31, 2005.<br />

F2. Employee stock options, 2001–2006<br />

In 2001, the Board of <strong>Skanska</strong> AB decided to allot a total of 2,040,000 options to 21<br />

individuals in <strong>Skanska</strong>’s Group Management. In February <strong>2002</strong>, the Board of <strong>Skanska</strong><br />

AB approved an additional allotment of options. After the above decisions, and after<br />

adjustments due to employee attrition, 33 individuals are covered by the 2001–2006<br />

employee stock option program, and the number of options totals 2,884,000.<br />

Claes Björk, then CEO, received 80,000 options. Stuart Graham, now CEO,<br />

received 80,000 options.<br />

The exercise price amounts to SEK 128, equivalent to 125 percent of the average<br />

closing price paid for a <strong>Skanska</strong> Series B share during the period June 14–20, 2001.<br />

The options may be exercised during the period March 3, 2004–March 31, 2006.<br />

F3. Terms of employee stock options<br />

For the above-mentioned employee stock option programs, the following are<br />

among the conditions that apply. The option programs encompass synthetic options<br />

and settlement will take place in cash. The options were provided free of cost and<br />

may only be exercised on the condition that the holder is still employed by <strong>Skanska</strong><br />

on the exercise date or has retired with a pension. The holder may not transfer the<br />

right to exercise the options. <strong>Skanska</strong> has hedged the obligations that the Company<br />

may incur as a consequence of a market price upturn.<br />

The market value, SEK 6.82 per option, for the year’s allocations of 2001–2006<br />

stock options was established according to the Black-Scholes valuation model.<br />

Based on an analysis of the historical volatility of the market price of the Company’s<br />

shares and those of comparable companies, the expected volatility during the life of<br />

the options has been estimated at 35 percent.<br />

The principles for reporting of employee stock options in the financial statements<br />

can be found under “Accounting and valuation principles.”<br />

Of whom<br />

Of whom<br />

<strong>2002</strong> men 2001 men<br />

Parent Company<br />

Sweden 56 3152 28<br />

Subsidiaries<br />

Sweden 14,958 13,253 15,713 13,843<br />

Norway 4,820 4,437 4,806 4,412<br />

Denmark 2,2712,089 3,098 2,807<br />

Finland 3,383 3,025 3,6813,251<br />

United Kingdom 4,209 3,709 4,239 3,726<br />

Poland 6,243 5,275 10,020 8,510<br />

Czech Republic 6,526 5,556 7,4416,321<br />

United States 9,462 8,339 10,033 8,689<br />

Argentina 2,157 2,106 3,281 3,204<br />

Hong Kong 3,155 2,788 4,061 3,561<br />

India 2,250 2,228 2,094 2,052<br />

Other countries 16,868 16,018 11,405 10,645<br />

Total 76,358 68,854 79,924 71,049<br />

Note 14<br />

Fees and other remuneration to auditors<br />

Group <strong>2002</strong> 2001<br />

KPMG<br />

Auditing assignments 44 40<br />

Other assignments 33 21<br />

Other auditors<br />

Auditing assignments 2 2<br />

Other assignments 1<br />

Total 80 63<br />

“Auditing assignments” refer to examination of the annual accounts as well as the<br />

administration by the Board of Directors and the President, as well as other tasks<br />

that are incumbent upon the Company’s auditors to perform. Everything else is<br />

“Other assignments.” “Other assignments” mainly consist of consultations related<br />

to tax and accounting matters as well as due diligence assignments.<br />

Note 15<br />

Share of income in Group companies<br />

Parent Company <strong>2002</strong> 2001<br />

Dividends 1,946 673<br />

Capital gains 48 25<br />

Writedowns –141 –488<br />

Total 1,853 210<br />

The amount for “Dividends” in <strong>2002</strong> consisted of SEK 1,216 M in dividends<br />

approved by shareholders’ meetings and SEK 730 M in net Group contributions provided<br />

and received. In 2001, the amount consisted of SEK 2 M in dividends approved<br />

by shareholders’ meetings, and SEK 688 M in net Group contributions provided and<br />

received, minus SEK 17 M in shareholder contributions provided.<br />

Note 16<br />

Income from holdings in associated companies and joint ventures<br />

Group <strong>2002</strong> 2001<br />

Income 5 69<br />

Total 5 69<br />

Notes to the financial statements – <strong>Skanska</strong> Annual Report <strong>2002</strong> 53