ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

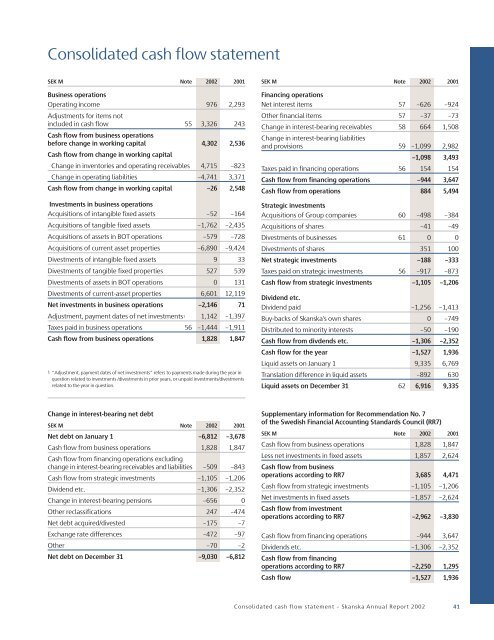

Consolidated cash flow statement<br />

SEK M Note <strong>2002</strong> 2001<br />

Business operations<br />

Operating income 976 2,293<br />

Adjustments for items not<br />

included in cash flow 55 3,326 243<br />

Cash flow from business operations<br />

before change in working capital 4,302 2,536<br />

Cash flow from change in working capital<br />

Change in inventories and operating receivables 4,715 –823<br />

Change in operating liabilities –4,7413,371<br />

Cash flow from change in working capital –26 2,548<br />

Investments in business operations<br />

Acquisitions of intangible fixed assets –52 –164<br />

Acquisitions of tangible fixed assets –1,762 –2,435<br />

Acquisitions of assets in BOT operations –579 –728<br />

Acquisitions of current asset properties –6,890 –9,424<br />

Divestments of intangible fixed assets 9 33<br />

Divestments of tangible fixed properties 527 539<br />

Divestments of assets in BOT operations 0 131<br />

Divestments of current-asset properties 6,601 12,119<br />

Net investments in business operations –2,146 71<br />

Adjustment, payment dates of net investments 1 1,142 –1,397<br />

Taxes paid in business operations 56 –1,444 –1,911<br />

Cash flow from business operations 1,828 1,847<br />

1 “Adjustment, payment dates of net investments” refers to payments made during the year in<br />

question related to investments /divestments in prior years, or unpaid investments/divestments<br />

related to the year in question.<br />

SEK M Note <strong>2002</strong> 2001<br />

Financing operations<br />

Net interest items 57 –626 –924<br />

Other financial items 57 –37 –73<br />

Change in interest-bearing receivables 58 664 1,508<br />

Change in interest-bearing liabilities<br />

and provisions 59 –1,099 2,982<br />

–1,098 3,493<br />

Taxes paid in financing operations 56 154 154<br />

Cash flow from financing operations –944 3,647<br />

Cash flow from operations 884 5,494<br />

Strategic investments<br />

Acquisitions of Group companies 60 –498 –384<br />

Acquisitions of shares –41–49<br />

Divestments of businesses 610 0<br />

Divestments of shares 351100<br />

Net strategic investments –188 –333<br />

Taxes paid on strategic investments 56 –917 –873<br />

Cash flow from strategic investments –1,105 –1,206<br />

Dividend etc.<br />

Dividend paid –1,256 –1,413<br />

Buy-backs of <strong>Skanska</strong>’s own shares 0 –749<br />

Distributed to minority interests –50 –190<br />

Cash flow from divdends etc. –1,306 –2,352<br />

Cash flow for the year –1,527 1,936<br />

Liquid assets on January 19,335 6,769<br />

Translation difference in liquid assets –892 630<br />

Liquid assets on December 31 62 6,916 9,335<br />

Change in interest-bearing net debt<br />

SEK M Note <strong>2002</strong> 2001<br />

Net debt on January 1 –6,812 –3,678<br />

Cash flow from business operations 1,828 1,847<br />

Cash flow from financing operations excluding<br />

change in interest-bearing receivables and liabilities –509 –843<br />

Cash flow from strategic investments –1,105 –1,206<br />

Dividend etc. –1,306 –2,352<br />

Change in interest-bearing pensions –656 0<br />

Other reclassifications 247 –474<br />

Net debt acquired/divested –175 –7<br />

Exchange rate differences –472 –97<br />

Other –70 –2<br />

Net debt on December 31 –9,030 –6,812<br />

Supplementary information for Recommendation No. 7<br />

of the Swedish Financial Accounting Standards Council (RR7)<br />

SEK M Note <strong>2002</strong> 2001<br />

Cash flow from business operations 1,828 1,847<br />

Less net investments in fixed assets 1,857 2,624<br />

Cash flow from business<br />

operations according to RR7 3,685 4,471<br />

Cash flow from strategic investments –1,105 –1,206<br />

Net investments in fixed assets –1,857 –2,624<br />

Cash flow from investment<br />

operations according to RR7 –2,962 –3,830<br />

Cash flow from financing operations –944 3,647<br />

Dividends etc. –1,306 –2,352<br />

Cash flow from financing<br />

operations according to RR7 –2,250 1,295<br />

Cash flow –1,527 1,936<br />

Consolidated cash flow statement – <strong>Skanska</strong> Annual Report <strong>2002</strong> 41