ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

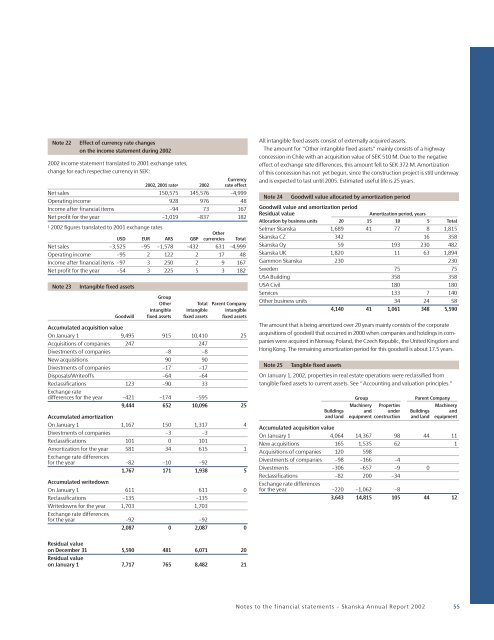

Note 22<br />

Effect of currency rate changes<br />

on the income statement during <strong>2002</strong><br />

<strong>2002</strong> income statement translated to 2001 exchange rates,<br />

change for each respective currency in SEK:<br />

Currency<br />

<strong>2002</strong>, 2001 rate 1 <strong>2002</strong> rate effect<br />

Net sales 150,575 145,576 –4,999<br />

Operating income 928 976 48<br />

Income after financial items –94 73 167<br />

Net profit for the year –1,019 –837 182<br />

1 <strong>2002</strong> figures translated to 2001 exchange rates<br />

Other<br />

USD EUR ARS GBP currencies Total<br />

Net sales –3,525 –95 –1,578 –432 631 –4,999<br />

Operating income –95 2 122 2 17 48<br />

Income after financial items –97 3 250 2 9 167<br />

Net profit for the year –54 3 225 5 3 182<br />

Note 23<br />

Intangible fixed assets<br />

Group<br />

Other Total Parent Company<br />

intangible intangible intangible<br />

Goodwill fixed assets fixed assets fixed assets<br />

Accumulated acquisition value<br />

On January 1 9,495 915 10,410 25<br />

Acquisitions of companies 247 247<br />

Divestments of companies –8 –8<br />

New acquisitions 90 90<br />

Divestments of companies –17 –17<br />

Disposals/Writeoffs –64 –64<br />

Reclassifications 123 –90 33<br />

Exchange rate<br />

differences for the year –421–174 –595<br />

9,444 652 10,096 25<br />

Accumulated amortization<br />

On January 1 1,167 150 1,317 4<br />

Divestments of companies –3 –3<br />

Reclassifications 101 0 101<br />

Exchange rate differences<br />

for the year –82 –10 –92<br />

1,767 171 1,938 5<br />

Accumulated writedown<br />

On January 1 611 611 0<br />

Reclassifications –135 –135<br />

Writedowns for the year 1,703 1,703<br />

Exchange rate differences<br />

for the year –92 –92<br />

2,087 0 2,087 0<br />

Residual value<br />

on December 31 5,590 481 6,071 20<br />

Residual value<br />

on January 1 7,717 765 8,482 21<br />

All intangible fixed assets consist of externally acquired assets.<br />

The amount for “Other intangible fixed assets” mainly consists of a highway<br />

concession in Chile with an acquisition value of SEK 510 M. Due to the negative<br />

effect of exchange rate differences, this amount fell to SEK 372 M. Amortization<br />

of this concession has not yet begun, since the construction project is still underway<br />

and is expected to last until 2005. Estimated useful life is 25 years.<br />

Note 24 Goodwill value allocated by amortization period<br />

Goodwill value and amortization period<br />

Residual value<br />

Amortization period, years<br />

Allocation by business units 20 15 10 5 Total<br />

Selmer <strong>Skanska</strong> 1,689 41 77 8 1,815<br />

<strong>Skanska</strong> CZ 342 16 358<br />

<strong>Skanska</strong> Oy 59 193 230 482<br />

<strong>Skanska</strong> UK 1,820 11 63 1,894<br />

Gammon <strong>Skanska</strong> 230 230<br />

Sweden 75 75<br />

USA Building 358 358<br />

USA Civil 180 180<br />

Services 133 7 140<br />

Other business units 34 24 58<br />

4,140 41 1,061 348 5,590<br />

The amount that is being amortized over 20 years mainly consists of the corporate<br />

acquisitions of goodwill that occurred in 2000 when companies and holdings in companies<br />

were acquired in Norway, Poland, the Czech Republic, the United Kingdom and<br />

Hong Kong. The remaining amortization period for this goodwill is about 17.5 years.<br />

Note 25 Tangible fixed assets<br />

On January 1, <strong>2002</strong>, properties in real estate operations were reclassified from<br />

tangible fixed assets to current assets. See “Accounting and valuation principles.”<br />

Group<br />

Parent Company<br />

Machinery Properties Machinery<br />

Buildings and under Buildings and<br />

and land equipment construction and land equipment<br />

Accumulated acquisition value<br />

On January 1 4,064 14,367 98 44 11<br />

New acquisitions 165 1,535 62 1<br />

Amortization for the year 58134 615 1<br />

Acquisitions of companies 120 598<br />

Divestments of companies –98 –166 –4<br />

Divestments –306 –657 –9 0<br />

Reclassifications –82 200 –34<br />

Exchange rate differences<br />

for the year –220 –1,062 –8<br />

3,643 14,815 105 44 12<br />

Notes to the financial statements – <strong>Skanska</strong> Annual Report <strong>2002</strong> 55