ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

ANNUAL REPORT 2002 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the financial<br />

statements<br />

Amounts in SEK million unless otherwise specified.<br />

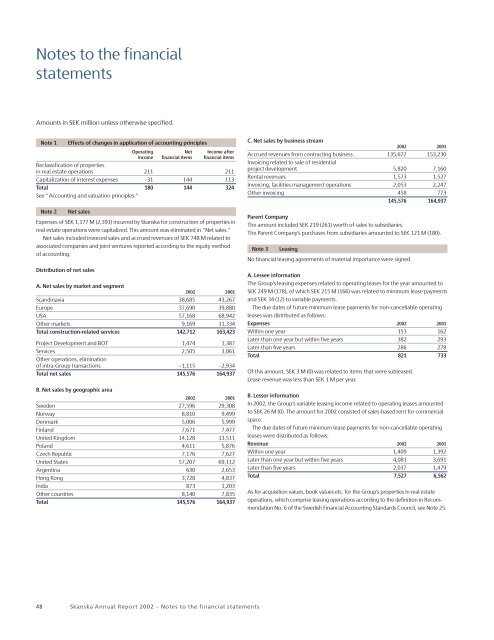

Note 1 Effects of changes in application of accounting principles<br />

Operating Net Income after<br />

income financial items financial items<br />

Reclassification of properties<br />

in real estate operations 211 211<br />

Capitalization of interest expenses –31 144 113<br />

Total 180 144 324<br />

See “Accounting and valuation principles.”<br />

Note 2 Net sales<br />

Expenses of SEK 1,177 M (2,391) incurred by <strong>Skanska</strong> for construction of properties in<br />

real estate operations were capitalized. This amount was eliminated in “Net sales.”<br />

Net sales included invoiced sales and accrued revenues of SEK 748 M related to<br />

associated companies and joint ventures reported according to the equity method<br />

of accounting.<br />

Distribution of net sales<br />

A. Net sales by market and segment<br />

<strong>2002</strong> 2001<br />

Scandinavia 38,685 43,267<br />

Europe 37,690 39,880<br />

USA 57,168 68,942<br />

Other markets 9,169 11,334<br />

Total construction-related services 142,712 163,423<br />

Project Development and BOT 1,474 1,387<br />

Services 2,505 3,061<br />

Other operations, elimination<br />

of intra-Group transactions –1,115 –2,934<br />

Total net sales 145,576 164,937<br />

B. Net sales by geographic area<br />

<strong>2002</strong> 2001<br />

Sweden 27,596 29,308<br />

Norway 8,810 9,499<br />

Denmark 5,006 5,999<br />

Finland 7,6717,477<br />

United Kingdom 14,128 13,511<br />

Poland 4,611 5,876<br />

Czech Republic 7,176 7,627<br />

United States 57,207 69,112<br />

Argentina 630 2,653<br />

Hong Kong 3,728 4,837<br />

India 873 1,203<br />

Other countries 8,140 7,835<br />

Total 145,576 164,937<br />

C. Net sales by business stream<br />

<strong>2002</strong> 2001<br />

Accrued revenues from contracting business 135,672 153,230<br />

Invoicing related to sale of residential<br />

project development 5,820 7,160<br />

Rental revenues 1,573 1,527<br />

Invoicing, facilities management operations 2,053 2,247<br />

Other invoicing 458 773<br />

145,576 164,937<br />

Parent Company<br />

The amount included SEK 219 (261) worth of sales to subsidiaries.<br />

The Parent Company’s purchases from subsidiaries amounted to SEK 121 M (180).<br />

Note 3 Leasing<br />

No financial leasing agreements of material importance were signed.<br />

A. Lessee information<br />

The Group’s leasing expenses related to operating leases for the year amounted to<br />

SEK 249 M (178), of which SEK 215 M (166) was related to minimum lease payments<br />

and SEK 34 (12) to variable payments.<br />

The due dates of future minimum lease payments for non-cancellable operating<br />

leases was distributed as follows:<br />

Expenses <strong>2002</strong> 2001<br />

Within one year 153 162<br />

Later than one year but within five years 382 293<br />

Later than five years 286 278<br />

Total 821 733<br />

Of this amount, SEK 3 M (0) was related to items that were subleased.<br />

Lease revenue was less than SEK 1 M per year.<br />

B. Lessor information<br />

In <strong>2002</strong>, the Group’s variable leasing income related to operating leases amounted<br />

to SEK 26 M (0). The amount for <strong>2002</strong> consisted of sales-based rent for commercial<br />

space.<br />

The due dates of future minimum lease payments for non-cancellable operating<br />

leases were distributed as follows:<br />

Revenue <strong>2002</strong> 2001<br />

Within one year 1,409 1,392<br />

Later than one year but within five years 4,0813,691<br />

Later than five years 2,037 1,479<br />

Total 7,527 6,562<br />

As for acquisition values, book values etc. for the Group’s properties in real estate<br />

operations, which comprise leasing operations according to the definition in Recommendation<br />

No. 6 of the Swedish Financial Accounting Standards Council, see Note 25.<br />

48 <strong>Skanska</strong> Annual Report <strong>2002</strong> – Notes to the financial statements