Wale Aboyade's thesis - lumes

Wale Aboyade's thesis - lumes

Wale Aboyade's thesis - lumes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Akinwale Aboyade, LUMES Thesis, 2003/2004<br />

by electricity produced from the project (UNFCCC 2004b). Such emissions are not considered in this<br />

study.<br />

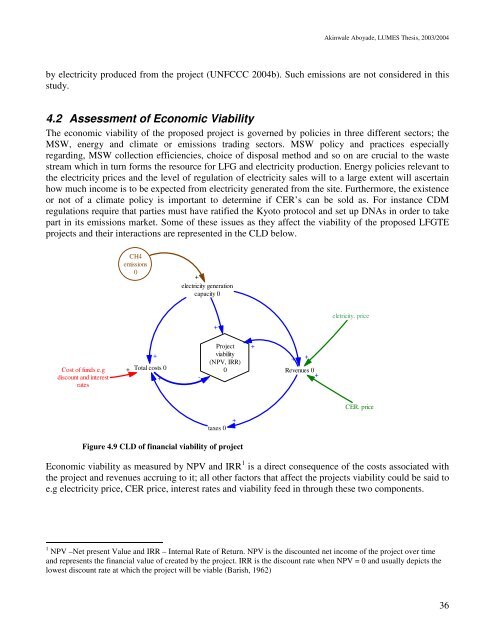

4.2 Assessment of Economic Viability<br />

The economic viability of the proposed project is governed by policies in three different sectors; the<br />

MSW, energy and climate or emissions trading sectors. MSW policy and practices especially<br />

regarding, MSW collection efficiencies, choice of disposal method and so on are crucial to the waste<br />

stream which in turn forms the resource for LFG and electricity production. Energy policies relevant to<br />

the electricity prices and the level of regulation of electricity sales will to a large extent will ascertain<br />

how much income is to be expected from electricity generated from the site. Furthermore, the existence<br />

or not of a climate policy is important to determine if CER’s can be sold as. For instance CDM<br />

regulations require that parties must have ratified the Kyoto protocol and set up DNAs in order to take<br />

part in its emissions market. Some of these issues as they affect the viability of the proposed LFGTE<br />

projects and their interactions are represented in the CLD below.<br />

CH4<br />

emissions<br />

0<br />

+<br />

electricity generation<br />

capacity 0<br />

+<br />

eletricity. price<br />

Cost of funds e.g<br />

discount and interest<br />

rates<br />

+<br />

Project +<br />

+<br />

viability<br />

+ +<br />

(NPV, IRR)<br />

Total costs 0 0<br />

Revenues 0<br />

+<br />

-<br />

+<br />

CER. price<br />

taxes 0<br />

+<br />

Figure 4.9 CLD of financial viability of project<br />

Economic viability as measured by NPV and IRR 1 is a direct consequence of the costs associated with<br />

the project and revenues accruing to it; all other factors that affect the projects viability could be said to<br />

e.g electricity price, CER price, interest rates and viability feed in through these two components.<br />

1 NPV –Net present Value and IRR – Internal Rate of Return. NPV is the discounted net income of the project over time<br />

and represents the financial value of created by the project. IRR is the discount rate when NPV = 0 and usually depicts the<br />

lowest discount rate at which the project will be viable (Barish, 1962)<br />

36