Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Corporate Governance Report<br />

Remuneration Committee<br />

The Remuneration Committee (the “RC”) comprises Phillip Chan as Chairman, independent director Rohan Kamis and CEO Alex Yeo.<br />

RC Chairman, Phillip Chan, was a former group administrator of Neptune Orient Lines, a public listed company engaging in global transportation.<br />

He was responsible for the group’s human resources management including executive compensation practices and policies. All other members of<br />

the RC are familiar with the sphere of executive compensation.<br />

The RC has been authorised by the Board to carry out the following key duties and responsibilities:<br />

• review and establish executive remuneration policy;<br />

• approve the remuneration packages and service terms of key executives;<br />

• administer the Employee Share Option Scheme;<br />

• recommend directors fees to the Board.<br />

During the year, the RC met three times with full attendance of its members to focus on the following:<br />

1) formalisation of a remuneration and compensation policy for executives; and the introduction of staff grades, salary structure and staff benefits;<br />

2) application and implementation of the guidelines on the payment of director’s fees;<br />

3) administration of the Employee Share Option Scheme including a review of the terms of the Scheme;<br />

In preparation of the adoption of the revised Code of Corporate Governance 2005 (the revised Code”), which will take effect from 1 January 2007<br />

and which require that the members of RC to be entirely non-executive directors, CEO Alex Yeo stepped down as a member of RC on 4 November<br />

2005.<br />

Disclosure on Remuneration<br />

The two Executive Directors of the Company have Service Agreements to govern their appointments. The salient points of the terms are disclosed<br />

in the IPO Prospectus dated 3 November 2004. Save for Directors’ fees, which have to be approved by the Shareholders at every Annual General<br />

Meeting (the “AGM”), the independent Directors do not receive any remuneration from the Company.<br />

The remuneration of the Executive Directors include, among others, a fixed salary and a performance driven variable bonus which is designed to<br />

align their performance with the interests of the Shareholders.<br />

In FY04, the shareholders had approved an employee share option scheme, known as <strong>Swissco</strong> Share Option Scheme (the “Scheme”). The Company<br />

has implemented the Scheme and granted 300,000 share options to each of the executive directors at an exercise price of S$0.244.<br />

Based on the existing terms and conditions of employment, there are no onerous compensation commitments on the part of the Company in the<br />

event of termination of the services of the Executive Directors.<br />

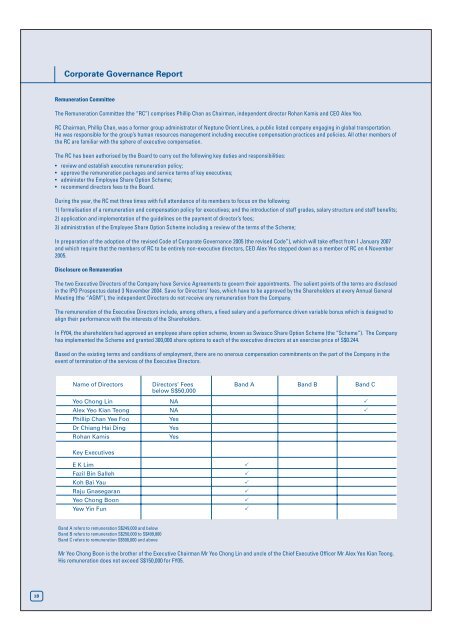

Name of Directors Directors’ Fees Band A Band B Band C<br />

below S$50,000<br />

Yeo Chong Lin NA ̌<br />

Alex Yeo Kian Teong NA ̌<br />

Phillip Chan Yee Foo<br />

Yes<br />

Dr Chiang Hai Ding<br />

Yes<br />

Rohan Kamis<br />

Yes<br />

Key Executives<br />

E K Lim<br />

Fazil Bin Salleh<br />

Koh Bai Yau<br />

Raju Gnasegaran<br />

Yeo Chong Boon<br />

Yew Yin Fun<br />

̌<br />

̌<br />

̌<br />

̌<br />

̌<br />

̌<br />

Band A refers to remuneration S$249,000 and below<br />

Band B refers to remuneration S$250,000 to S$499,000<br />

Band C refers to remuneration S$500,000 and above<br />

Mr Yeo Chong Boon is the brother of the Executive Chairman Mr Yeo Chong Lin and uncle of the Chief Executive Officer Mr Alex Yeo Kian Teong.<br />

His remuneration does not exceed S$150,000 for FY05.<br />

18