Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the financial year ended 31 December 2005<br />

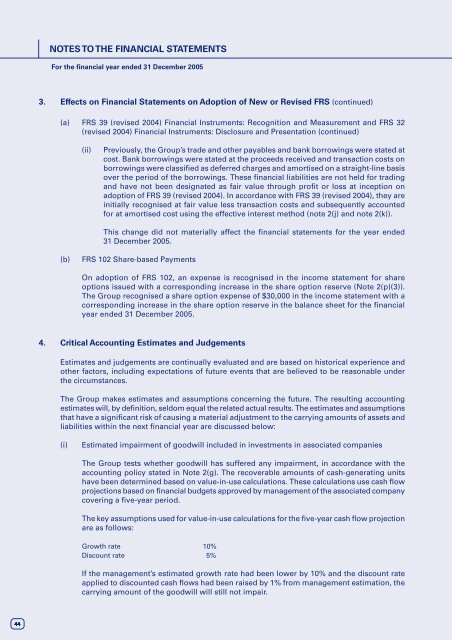

3. Effects on Financial Statements on Adoption of New or Revised FRS (continued)<br />

(a) FRS 39 (revised 2004) Financial Instruments: Recognition and Measurement and FRS 32<br />

(revised 2004) Financial Instruments: Disclosure and Presentation (continued)<br />

(ii)<br />

Previously, the Group’s trade and other payables and bank borrowings were stated at<br />

cost. Bank borrowings were stated at the proceeds received and transaction costs on<br />

borrowings were classified as deferred charges and amortised on a straight-line basis<br />

over the period of the borrowings. These financial liabilities are not held for trading<br />

and have not been designated as fair value through profit or loss at inception on<br />

adoption of FRS 39 (revised 2004). In accordance with FRS 39 (revised 2004), they are<br />

initially recognised at fair value less transaction costs and subsequently accounted<br />

for at amortised cost using the effective interest method (note 2(j) and note 2(k)).<br />

This change did not materially affect the financial statements for the year ended<br />

31 December 2005.<br />

(b)<br />

FRS 102 Share-based Payments<br />

On adoption of FRS 102, an expense is recognised in the income statement for share<br />

options issued with a corresponding increase in the share option reserve (Note 2(p)(3)).<br />

The Group recognised a share option expense of $30,000 in the income statement with a<br />

corresponding increase in the share option reserve in the balance sheet for the financial<br />

year ended 31 December 2005.<br />

4. Critical Accounting Estimates and Judgements<br />

Estimates and judgements are continually evaluated and are based on historical experience and<br />

other factors, including expectations of future events that are believed to be reasonable under<br />

the circumstances.<br />

The Group makes estimates and assumptions concerning the future. The resulting accounting<br />

estimates will, by definition, seldom equal the related actual results. The estimates and assumptions<br />

that have a significant risk of causing a material adjustment to the carrying amounts of assets and<br />

liabilities within the next financial year are discussed below:<br />

(i)<br />

Estimated impairment of goodwill included in investments in associated companies<br />

The Group tests whether goodwill has suffered any impairment, in accordance with the<br />

accounting policy stated in Note 2(g). The recoverable amounts of cash-generating units<br />

have been determined based on value-in-use calculations. These calculations use cash flow<br />

projections based on financial budgets approved by management of the associated company<br />

covering a five-year period.<br />

The key assumptions used for value-in-use calculations for the five-year cash flow projection<br />

are as follows:<br />

Growth rate 10%<br />

Discount rate 5%<br />

If the management’s estimated growth rate had been lower by 10% and the discount rate<br />

applied to discounted cash flows had been raised by 1% from management estimation, the<br />

carrying amount of the goodwill will still not impair.<br />

44