Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the financial year ended 31 December 2005<br />

25. Share Capital of <strong>Swissco</strong> International <strong>Limited</strong> (continued)<br />

(c)<br />

Share options (continued)<br />

In relation to an option granted to a person who is a controlling shareholder or an associate<br />

of a controlling shareholder, the subscription price for each Scheme share shall be equal to<br />

the average of the last dealt prices for the Company’s share for the 5 consecutive market<br />

days immediately preceding the latest practicable date prior to the date of any circular,<br />

letter or notice to the shareholders proposing to seek their approval of the grant of such<br />

options to such controlling shareholder or, as the case may be, such associate.<br />

The option can be exercised to subscribe for the ordinary shares of the Company in the<br />

following proportions after the vesting period:<br />

After the first anniversary of date of grant<br />

of the Option<br />

After the second anniversary of date of<br />

grant of the Option<br />

After the third anniversary of date of grant<br />

of the Option<br />

Maximum of 40% of Shares comprised<br />

in such Option<br />

Maximum of 70% Shares comprised<br />

in such Option<br />

100% of Shares comprised in such Option<br />

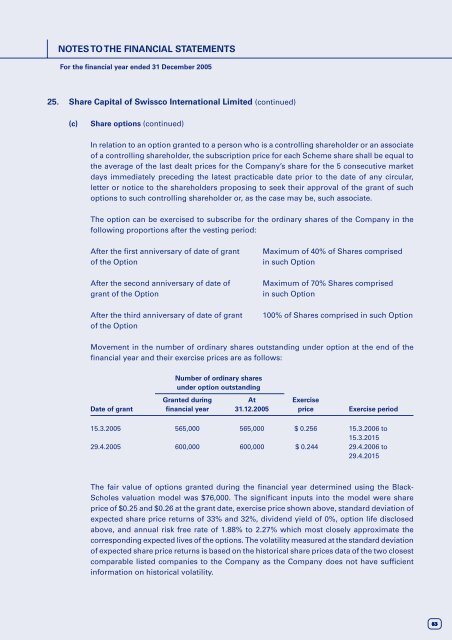

Movement in the number of ordinary shares outstanding under option at the end of the<br />

financial year and their exercise prices are as follows:<br />

Number of ordinary shares<br />

under option outstanding<br />

Granted during At Exercise<br />

Date of grant financial year 31.12.2005 price Exercise period<br />

15.3.2005 565,000 565,000 $ 0.256 15.3.2006 to<br />

15.3.2015<br />

29.4.2005 600,000 600,000 $ 0.244 29.4.2006 to<br />

29.4.2015<br />

The fair value of options granted during the financial year determined using the Black-<br />

Scholes valuation model was $76,000. The significant inputs into the model were share<br />

price of $0.25 and $0.26 at the grant date, exercise price shown above, standard deviation of<br />

expected share price returns of 33% and 32%, dividend yield of 0%, option life disclosed<br />

above, and annual risk free rate of 1.88% to 2.27% which most closely approximate the<br />

corresponding expected lives of the options. The volatility measured at the standard deviation<br />

of expected share price returns is based on the historical share prices data of the two closest<br />

comparable listed companies to the Company as the Company does not have sufficient<br />

information on historical volatility.<br />

63