Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the financial year ended 31 December 2005<br />

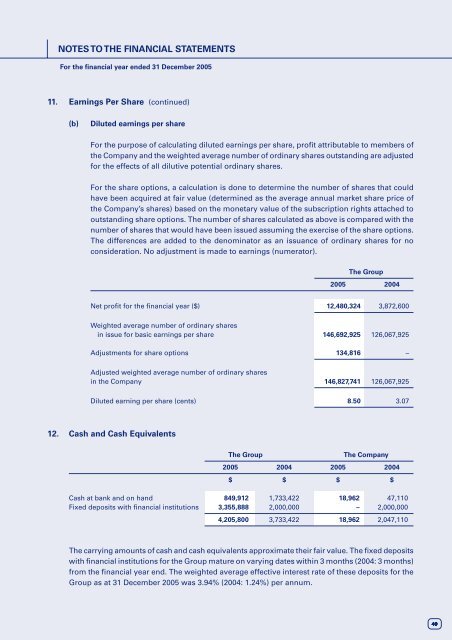

11. Earnings Per Share (continued)<br />

(b)<br />

Diluted earnings per share<br />

For the purpose of calculating diluted earnings per share, profit attributable to members of<br />

the Company and the weighted average number of ordinary shares outstanding are adjusted<br />

for the effects of all dilutive potential ordinary shares.<br />

For the share options, a calculation is done to determine the number of shares that could<br />

have been acquired at fair value (determined as the average annual market share price of<br />

the Company’s shares) based on the monetary value of the subscription rights attached to<br />

outstanding share options. The number of shares calculated as above is compared with the<br />

number of shares that would have been issued assuming the exercise of the share options.<br />

The differences are added to the denominator as an issuance of ordinary shares for no<br />

consideration. No adjustment is made to earnings (numerator).<br />

The Group<br />

2005 2004<br />

Net profit for the financial year ($) 12,480,324 3,872,600<br />

Weighted average number of ordinary shares<br />

in issue for basic earnings per share 146,692,925 126,067,925<br />

Adjustments for share options 134,816 –<br />

Adjusted weighted average number of ordinary shares<br />

in the Company 146,827,741 126,067,925<br />

Diluted earning per share (cents) 8.50 3.07<br />

12. Cash and Cash Equivalents<br />

The Group<br />

The Company<br />

2005 2004 2005 2004<br />

$ $ $ $<br />

Cash at bank and on hand 849,912 1,733,422 18,962 47,110<br />

Fixed deposits with financial institutions 3,355,888 2,000,000 – 2,000,000<br />

4,205,800 3,733,422 18,962 2,047,110<br />

The carrying amounts of cash and cash equivalents approximate their fair value. The fixed deposits<br />

with financial institutions for the Group mature on varying dates within 3 months (2004: 3 months)<br />

from the financial year end. The weighted average effective interest rate of these deposits for the<br />

Group as at 31 December 2005 was 3.94% (2004: 1.24%) per annum.<br />

49