Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the financial year ended 31 December 2005<br />

2. Significant Accounting Policies (continued)<br />

(e)<br />

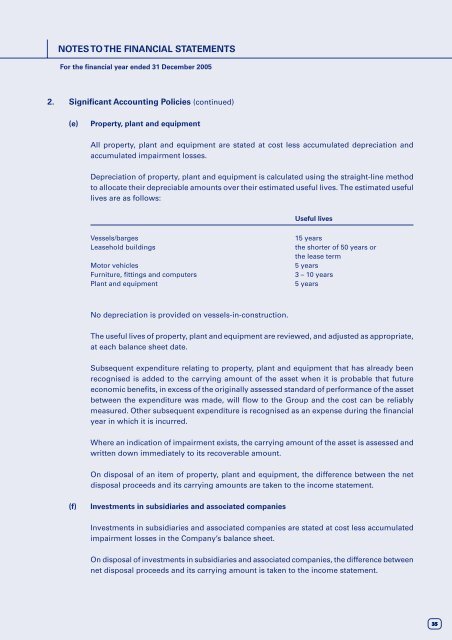

Property, plant and equipment<br />

All property, plant and equipment are stated at cost less accumulated depreciation and<br />

accumulated impairment losses.<br />

Depreciation of property, plant and equipment is calculated using the straight-line method<br />

to allocate their depreciable amounts over their estimated useful lives. The estimated useful<br />

lives are as follows:<br />

Useful lives<br />

Vessels/barges<br />

Leasehold buildings<br />

Motor vehicles<br />

Furniture, fittings and computers<br />

Plant and equipment<br />

15 years<br />

the shorter of 50 years or<br />

the lease term<br />

5 years<br />

3 – 10 years<br />

5 years<br />

No depreciation is provided on vessels-in-construction.<br />

The useful lives of property, plant and equipment are reviewed, and adjusted as appropriate,<br />

at each balance sheet date.<br />

Subsequent expenditure relating to property, plant and equipment that has already been<br />

recognised is added to the carrying amount of the asset when it is probable that future<br />

economic benefits, in excess of the originally assessed standard of performance of the asset<br />

between the expenditure was made, will flow to the Group and the cost can be reliably<br />

measured. Other subsequent expenditure is recognised as an expense during the financial<br />

year in which it is incurred.<br />

Where an indication of impairment exists, the carrying amount of the asset is assessed and<br />

written down immediately to its recoverable amount.<br />

On disposal of an item of property, plant and equipment, the difference between the net<br />

disposal proceeds and its carrying amounts are taken to the income statement.<br />

(f)<br />

Investments in subsidiaries and associated companies<br />

Investments in subsidiaries and associated companies are stated at cost less accumulated<br />

impairment losses in the Company’s balance sheet.<br />

On disposal of investments in subsidiaries and associated companies, the difference between<br />

net disposal proceeds and its carrying amount is taken to the income statement.<br />

35