Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Untitled - Swissco Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

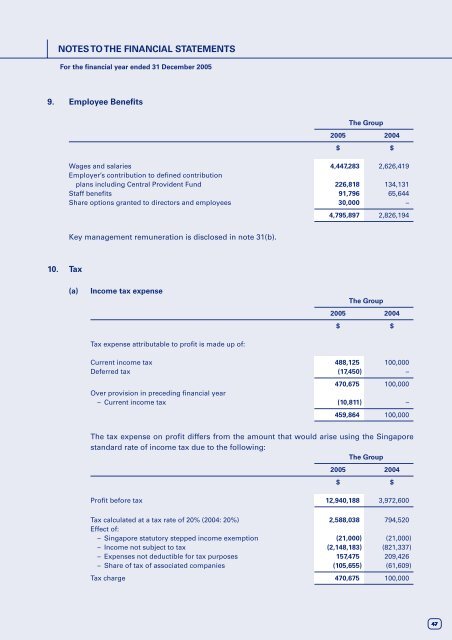

NOTES TO THE FINANCIAL STATEMENTS<br />

For the financial year ended 31 December 2005<br />

9. Employee Benefits<br />

The Group<br />

2005 2004<br />

$ $<br />

Wages and salaries 4,447,283 2,626,419<br />

Employer’s contribution to defined contribution<br />

plans including Central Provident Fund 226,818 134,131<br />

Staff benefits 91,796 65,644<br />

Share options granted to directors and employees 30,000 –<br />

4,795,897 2,826,194<br />

Key management remuneration is disclosed in note 31(b).<br />

10. Tax<br />

(a)<br />

Income tax expense<br />

Tax expense attributable to profit is made up of:<br />

The Group<br />

2005 2004<br />

$ $<br />

Current income tax 488,125 100,000<br />

Deferred tax (17,450) –<br />

470,675 100,000<br />

Over provision in preceding financial year<br />

– Current income tax (10,811) –<br />

459,864 100,000<br />

The tax expense on profit differs from the amount that would arise using the Singapore<br />

standard rate of income tax due to the following:<br />

The Group<br />

2005 2004<br />

$ $<br />

Profit before tax 12,940,188 3,972,600<br />

Tax calculated at a tax rate of 20% (2004: 20%) 2,588,038 794,520<br />

Effect of:<br />

– Singapore statutory stepped income exemption (21,000) (21,000)<br />

– Income not subject to tax (2,148,183) (821,337)<br />

– Expenses not deductible for tax purposes 157,475 209,426<br />

– Share of tax of associated companies (105,655) (61,609)<br />

Tax charge 470,675 100,000<br />

47