You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INVESTMENT RISK FACED BY PENSION INVESTORS<br />

Risk to Capital Value<br />

This is the risk most familiar to investors and the one on which most investors focus - the risk that the value of their<br />

investment will fall. This risk is of particular importance to investors with a short time horizon - e.g. one or two years - as<br />

they are most likely to be affected by a fall in capital values. For longer-term investors, the risk to the value of their capital is<br />

reduced as investment returns in the long run are more likely to be positive. For long term investors other risks become<br />

significantly more important, especially inflation risk.<br />

Inflation Risk<br />

This is perhaps the most important risk facing medium to long-term investors but one that is often overlooked in favour of<br />

the more obvious Capital Value risk, outlined above. The inflation risk relates to purchasing power. If your investments are<br />

earning a return of, say, 2% p.a. but prices are rising at 5% p.a., you are actually losing purchasing power at the rate of<br />

approximately 3% p.a. - even though the value of your fund is rising, prices are rising even faster so with every year that<br />

goes by, your money is able to buy you less and less.<br />

Annuity Rate Risk<br />

This risk is somewhat specific to <strong>pension</strong> investors. When you come to retire, a substantial portion of your accumulated<br />

fund may be used to purchase a <strong>pension</strong>. The amount of <strong>pension</strong> you can purchase depends on annuity rates at the time<br />

you retire and these can be somewhat volatile. The main factor leading to this volatility is long-term interest rates - if longterm<br />

interest rates fall, the cost of purchasing a <strong>pension</strong> can increase and vice versa. If the cost of purchasing a <strong>pension</strong><br />

increases immediately before retirement, you may not be able to afford as much of a <strong>pension</strong> as you had hoped. Note that<br />

this risk is typically not relevant to money which will be invested in ARFs or taken as tax-free cash at retirement.<br />

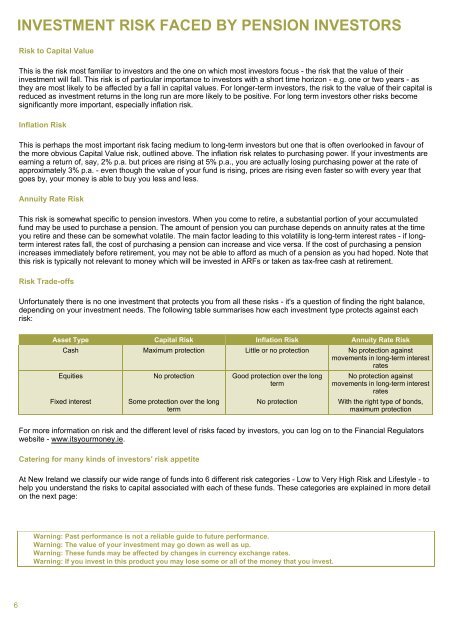

Risk Trade-offs<br />

Unfortunately there is no one investment that protects you from all these risks - it's a question of finding the right balance,<br />

depending on your investment needs. The following table summarises how each investment type protects against each<br />

risk:<br />

Asset Type Capital Risk Inflation Risk Annuity Rate Risk<br />

Cash Maximum protection Little or no protection No protection against<br />

movements in long-term interest<br />

rates<br />

Equities No protection Good protection over the long<br />

term<br />

Fixed interest<br />

Some protection over the long<br />

term<br />

No protection<br />

No protection against<br />

movements in long-term interest<br />

rates<br />

With the right type of bonds,<br />

maximum protection<br />

For more information on risk and the different level of risks faced by investors, you can log on to the Financial Regulators<br />

website - www.itsyourmoney.ie.<br />

Catering for many kinds of investors' risk appetite<br />

At <strong>New</strong> <strong>Ireland</strong> we classify our wide range of funds into 6 different risk categories - Low to Very High Risk and Lifestyle - to<br />

help you understand the risks to capital associated with each of these funds. These categories are explained in more detail<br />

on the next page:<br />

Warning: Past performance is not a reliable guide to future performance.<br />

Warning: The value of your investment may go down as well as up.<br />

Warning: These funds may be affected by changes in currency exchange rates.<br />

Warning: If you invest in this product you may lose some or all of the money that you invest.<br />

6