Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity Strategy 4Q 2009<br />

Strategy Overview: Asia Equity<br />

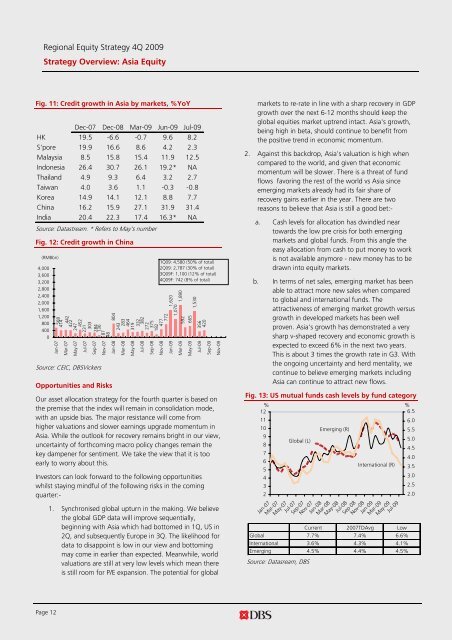

Fig. 11: Credit growth in Asia by markets, %YoY<br />

Dec-07 Dec-08 Mar-09 Jun-09 Jul-09<br />

HK 19.5 -6.6 -0.7 9.6 8.2<br />

S'pore 19.9 16.6 8.6 4.2 2.3<br />

Malaysia 8.5 15.8 15.4 11.9 12.5<br />

Indonesia 26.4 30.7 26.1 19.2* NA<br />

Thailand 4.9 9.3 6.4 3.2 2.7<br />

Taiwan 4.0 3.6 1.1 -0.3 -0.8<br />

Korea 14.9 14.1 12.1 8.8 7.7<br />

China 16.2 15.9 27.1 31.9 31.4<br />

India 20.4 22.3 17.4 16.3* NA<br />

Source: Datastream. * Refers to May’s number<br />

Fig. 12: Credit growth in China<br />

(RMBbn)<br />

4,000<br />

3,600<br />

3,200<br />

2,800<br />

2,400<br />

2,000<br />

1,600<br />

1,200<br />

800<br />

400<br />

0<br />

568<br />

414<br />

442<br />

422<br />

247<br />

452<br />

231<br />

303<br />

284<br />

136<br />

Source: CEIC, <strong>DBS</strong><strong>Vickers</strong><br />

87<br />

48<br />

Opportunities and Risks<br />

804<br />

243<br />

283<br />

464<br />

382<br />

332<br />

319<br />

272<br />

375<br />

182<br />

477<br />

1Q09: 4,580 (50% of total)<br />

2Q09: 2,787 (30% of total)<br />

3Q09F: 1,100 (12% of total)<br />

4Q09F: 742 (8% of total)<br />

Our asset allocation strategy for <strong>the</strong> fourth quarter is based on<br />

<strong>the</strong> premise that <strong>the</strong> index will remain in consolidation mode,<br />

with an upside bias. The major resistance will come from<br />

higher valuations and slower earnings upgrade momentum in<br />

Asia. While <strong>the</strong> outlook for recovery remains bright in our view,<br />

uncertainty of forthcoming macro policy changes remain <strong>the</strong><br />

key dampener for sentiment. We take <strong>the</strong> view that it is too<br />

early to worry about this.<br />

Investors can look forward to <strong>the</strong> following opportunities<br />

whilst staying mindful of <strong>the</strong> following risks in <strong>the</strong> coming<br />

quarter:-<br />

1. Synchronised global upturn in <strong>the</strong> making. We believe<br />

<strong>the</strong> global GDP data will improve sequentially,<br />

beginning with Asia which had bottomed in 1Q, US in<br />

2Q, and subsequently Europe in 3Q. The likelihood for<br />

data to disappoint is low in our view and bottoming<br />

may come in earlier than expected. Meanwhile, world<br />

valuations are still at very low levels which mean <strong>the</strong>re<br />

is still room for P/E expansion. The potential for global<br />

772<br />

1,620<br />

1,070<br />

1,890<br />

592<br />

665<br />

1,530<br />

356<br />

420<br />

Jan-07<br />

Mar-07<br />

May-07<br />

Jul-07<br />

Sep-07<br />

Nov-07<br />

Jan-08<br />

Mar-08<br />

May-08<br />

Jul-08<br />

Sep-08<br />

Nov-08<br />

Jan-09<br />

Mar-09<br />

May-09<br />

Jul-09<br />

Sep-09<br />

Nov-09<br />

markets to re-rate in line with a sharp recovery in GDP<br />

growth over <strong>the</strong> next 6-12 months should keep <strong>the</strong><br />

global equities market uptrend intact. Asia's growth,<br />

being high in beta, should continue to benefit from<br />

<strong>the</strong> positive trend in economic momentum.<br />

2. Against this backdrop, Asia's valuation is high when<br />

compared to <strong>the</strong> world, and given that economic<br />

momentum will be slower. There is a threat of fund<br />

flows favoring <strong>the</strong> rest of <strong>the</strong> world vs Asia since<br />

emerging markets already had its fair share of<br />

recovery gains earlier in <strong>the</strong> year. There are two<br />

reasons to believe that Asia is still a good bet:-<br />

a. Cash levels for allocation has dwindled near<br />

towards <strong>the</strong> low pre crisis for both emerging<br />

markets and global funds. From this angle <strong>the</strong><br />

easy allocation from cash to put money to work<br />

is not available anymore - new money has to be<br />

drawn into equity markets.<br />

b. In terms of net sales, emerging market has been<br />

able to attract more new sales when compared<br />

to global and international funds. The<br />

attractiveness of emerging market growth versus<br />

growth in developed markets has been well<br />

proven. Asia's growth has demonstrated a very<br />

sharp v-shaped recovery and economic growth is<br />

expected to exceed 6% in <strong>the</strong> next two years.<br />

This is about 3 times <strong>the</strong> growth rate in G3. With<br />

<strong>the</strong> ongoing uncertainty and herd mentality, we<br />

continue to believe emerging markets including<br />

Asia can continue to attract new flows.<br />

Fig. 13: US mutual funds cash levels by fund category<br />

%<br />

%<br />

12<br />

11<br />

10<br />

Emerging (R)<br />

9<br />

Global (L)<br />

8<br />

7<br />

6<br />

International (R)<br />

5<br />

4<br />

3<br />

2<br />

Jan-07<br />

Mar-07<br />

May-07<br />

Current 2007TDAvg Low<br />

Global 7.7% 7.4% 6.6%<br />

International 3.6% 4.3% 4.1%<br />

Emerging 4.5% 4.4% 4.5%<br />

Source: Datasream, <strong>DBS</strong><br />

Jul-07<br />

Sep-07<br />

Nov-07<br />

Jan-08<br />

Mar-08<br />

May-08<br />

Jul-08<br />

Sep-08<br />

Nov-08<br />

Jan-09<br />

Mar-09<br />

May-09<br />

Jul-09<br />

6.5<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

Page 12