Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity Strategy 4Q 2009<br />

Strategy Overview: Asia Equity<br />

2010 growth (%)<br />

Risk premiums declining as risk appetites improve<br />

Providing more fuel to our argument that Singapore's equity<br />

valuations have more room for upside is <strong>the</strong> equity risk<br />

premium (ERP). After <strong>the</strong> significant decrease in risk aversion<br />

since March 2009, <strong>the</strong> ERP has reverted to its long-term<br />

average levels of 4.2%. (Fig. 25)<br />

Fig. 25: Singapore equity risk premium<br />

10.0<br />

9.0<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

(%)<br />

1.0<br />

0.0<br />

01 02 03 04 05 06 07 08 09<br />

Source: Datastream, <strong>DBS</strong>. Earnings yield minus Singapore 10-year bond<br />

yield<br />

Our sensitivity analysis points to a fur<strong>the</strong>r 2% upside for <strong>the</strong><br />

FSSTI index if consensus forecasts of 18% earnings growth in<br />

FY10 holds. We arrive at a target of 2800 for <strong>the</strong> next 3<br />

months, where it will be supported by P/B and ERP calculations.<br />

In 2010, we could be looking at support levels of up to 18%<br />

from current levels if we expect “e” to return to pre-crisis levels<br />

by 2011. (Fig. 26)<br />

Fig. 26: Potential return from Interest rate / Growth<br />

sensitivity analysis based on ERP mean revision<br />

Singapore Long Bond yield (%)<br />

1.5 1.75 2 2.25 2.5 2.75 3<br />

18 11% 7% 2% -2% -5% -9% -12%<br />

23 16% 12% 7% 3% 0% -4% -7%<br />

28 21% 17% 12% 8% 5% 1% -2%<br />

33 26% 22% 17% 13% 10% 6% 3%<br />

38 31% 27% 22% 18% 15% 11% 8%<br />

43 36% 32% 27% 23% 20% 16% 13%<br />

48 41% 37% 32% 28% 25% 21% 18%<br />

Current support<br />

12-mth target<br />

Source: Datastream. Based on current index of 2681 and bond yield of<br />

2%<br />

The regional strategy team is arriving at a STI index target of<br />

3400 by end 2010. This is derived from a forward PER of 16.3x<br />

on 2011 “e” returning to pre-crisis high in 2007. We believe it<br />

is achievable for <strong>the</strong> “e” to return to pre-crisis level as<br />

accordingly absolute GDP level will return to pre-crisis levels by<br />

end of 2010 based on our nominal GDP growth forecasts.<br />

Hong Kong / China downgraded to Neutral<br />

Our Hong Kong strategist, Derek Cheung, is concerned of a<br />

correction on a market which has been driven by (1) high<br />

hopes of a US economic recovery, which may disappoint and<br />

(2) huge PRC pump-priming, which may dissipate (See Hong<br />

Kong strategy: “Wolatility, - wake up call"). While <strong>the</strong> regional<br />

team agrees that a pull back as a result of profit taking is<br />

probable, <strong>the</strong> downside should remain well supported at<br />

average valuations as <strong>the</strong> anticipated earnings upgrade after<br />

<strong>the</strong> result season has been on track. Derek's forecast for HSI at<br />

14000 represents a worst-case scenario should negative events<br />

converge on <strong>the</strong> market, which has thus far been more<br />

focused on upside surprises.<br />

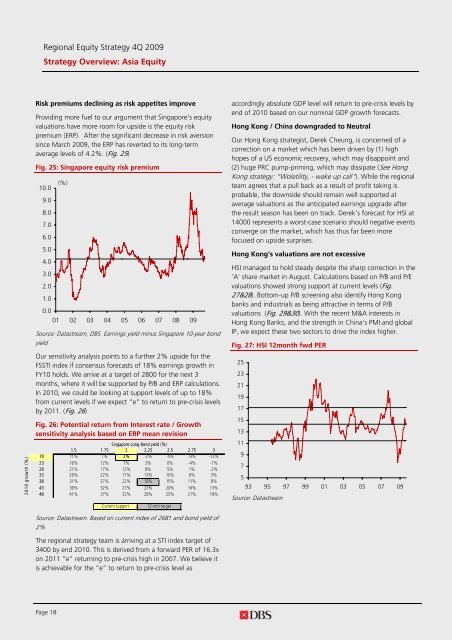

Hong Kong's valuations are not excessive<br />

HSI managed to hold steady despite <strong>the</strong> sharp correction in <strong>the</strong><br />

'A' share market in August. Calculations based on P/B and P/E<br />

valuations showed strong support at current levels (Fig.<br />

27&28). Bottom-up P/B screening also identify Hong Kong<br />

banks and industrials as being attractive in terms of P/B<br />

valuations (Fig. 29&30). With <strong>the</strong> recent M&A interests in<br />

Hong Kong Banks, and <strong>the</strong> strength in China's PMI and global<br />

IP, we expect <strong>the</strong>se two sectors to drive <strong>the</strong> index higher.<br />

Fig. 27: HSI 12month fwd PER<br />

25<br />

23<br />

21<br />

19<br />

17<br />

15<br />

13<br />

11<br />

9<br />

7<br />

5<br />

93 95 97 99 01 03 05 07 09<br />

Source: Datastream<br />

Page 18