Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity Strategy 4Q 2009<br />

Country Assessment<br />

with NPLs and provisions stabilizing. Consumer Goods<br />

earnings were bolstered by higher CPO prices for plantation<br />

stocks listed on SGX.<br />

Driven by topline growth and recovery in margins. Overall<br />

sales showed a sequential improvement (+12%) over 1Q09,<br />

led by Real Estate, Basic Materials, Oil and Gas and Financials.<br />

EBIT margins recovered from 1Q09 lows to previous year’s<br />

level of 15%, following cost cutting measures undertaken<br />

and improvement in top line. Margin recovery was evident in<br />

Healthcare, Industrials, Reits and Technology sectors.<br />

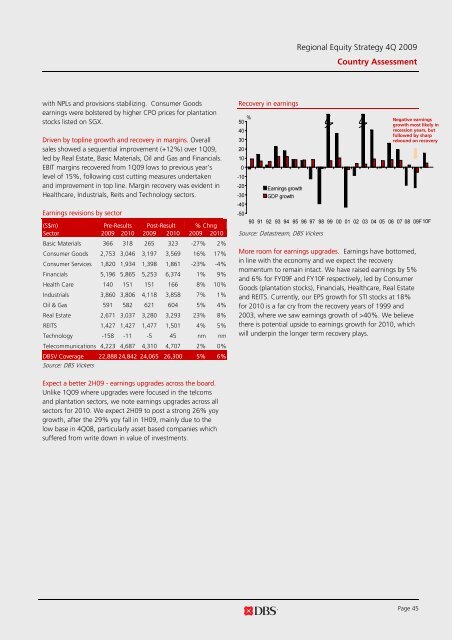

Earnings revisions by sector<br />

(S$m) Pre-Results Post-Result % Chng<br />

Sector 2009 2010 2009 2010 2009 2010<br />

Basic Materials 366 318 265 323 -27% 2%<br />

Consumer Goods 2,753 3,046 3,197 3,569 16% 17%<br />

Consumer Services 1,820 1,934 1,398 1,861 -23% -4%<br />

Financials 5,196 5,865 5,253 6,374 1% 9%<br />

Health Care 140 151 151 166 8% 10%<br />

Industrials 3,860 3,806 4,118 3,858 7% 1%<br />

Oil & Gas 591 582 621 604 5% 4%<br />

Real Estate 2,671 3,037 3,280 3,293 23% 8%<br />

REITS 1,427 1,427 1,477 1,501 4% 5%<br />

Technology -158 -11 -5 45 nm nm<br />

Telecommunications 4,223 4,687 4,310 4,707 2% 0%<br />

<strong>DBS</strong>V Coverage 22,888 24,842 24,065 26,300 5% 6%<br />

Source: <strong>DBS</strong> <strong>Vickers</strong><br />

Recovery in earnings<br />

%<br />

Negative earnings<br />

50<br />

growth most likely in<br />

40<br />

recession years, but<br />

followed by sharp<br />

30<br />

rebound on recovery<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

Earnings growth<br />

-30 GDP growth<br />

-40<br />

-50<br />

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09F10F<br />

Source: Datastream, <strong>DBS</strong> <strong>Vickers</strong><br />

More room for earnings upgrades. Earnings have bottomed,<br />

in line with <strong>the</strong> economy and we expect <strong>the</strong> recovery<br />

momentum to remain intact. We have raised earnings by 5%<br />

and 6% for FY09F and FY10F respectively, led by Consumer<br />

Goods (plantation stocks), Financials, Healthcare, Real Estate<br />

and REITS. Currently, our EPS growth for STI stocks at 18%<br />

for 2010 is a far cry from <strong>the</strong> recovery years of 1999 and<br />

2003, where we saw earnings growth of >40%. We believe<br />

<strong>the</strong>re is potential upside to earnings growth for 2010, which<br />

will underpin <strong>the</strong> longer term recovery plays.<br />

Expect a better 2H09 - earnings upgrades across <strong>the</strong> board.<br />

Unlike 1Q09 where upgrades were focused in <strong>the</strong> telcoms<br />

and plantation sectors, we note earnings upgrades across all<br />

sectors for 2010. We expect 2H09 to post a strong 26% yoy<br />

growth, after <strong>the</strong> 29% yoy fall in 1H09, mainly due to <strong>the</strong><br />

low base in 4Q08, particularly asset based companies which<br />

suffered from write down in value of investments.<br />

Page 45