Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

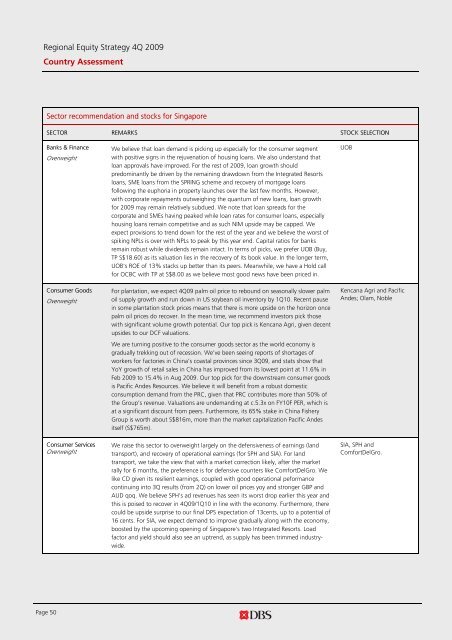

Regional Equity Strategy 4Q 2009<br />

Country Assessment<br />

Sector recommendation and stocks for Singapore<br />

SECTOR REMARKS STOCK SELECTION<br />

Banks & Finance<br />

Overweight<br />

Consumer Goods<br />

Overweight<br />

Consumer Services<br />

Overweight<br />

We believe that loan demand is picking up especially for <strong>the</strong> consumer segment<br />

with positive signs in <strong>the</strong> rejuvenation of housing loans. We also understand that<br />

loan approvals have improved. For <strong>the</strong> rest of 2009, loan growth should<br />

predominantly be driven by <strong>the</strong> remaining drawdown from <strong>the</strong> Integrated Resorts<br />

loans, SME loans from <strong>the</strong> SPRING scheme and recovery of mortgage loans<br />

following <strong>the</strong> euphoria in property launches over <strong>the</strong> last few months. However,<br />

with corporate repayments outweighing <strong>the</strong> quantum of new loans, loan growth<br />

for 2009 may remain relatively subdued. We note that loan spreads for <strong>the</strong><br />

corporate and SMEs having peaked while loan rates for consumer loans, especially<br />

housing loans remain competitive and as such NIM upside may be capped. We<br />

expect provisions to trend down for <strong>the</strong> rest of <strong>the</strong> year and we believe <strong>the</strong> worst of<br />

spiking NPLs is over with NPLs to peak by this year end. Capital ratios for banks<br />

remain robust while dividends remain intact. In terms of picks, we prefer UOB (Buy,<br />

TP S$18.60) as its valuation lies in <strong>the</strong> recovery of its book value. In <strong>the</strong> longer term,<br />

UOB's ROE of 13% stacks up better than its peers. Meanwhile, we have a Hold call<br />

for OCBC with TP at S$8.00 as we believe most good news have been priced in.<br />

For plantation, we expect 4Q09 palm oil price to rebound on seasonally slower palm<br />

oil supply growth and run down in US soybean oil inventory by 1Q10. Recent pause<br />

in some plantation stock prices means that <strong>the</strong>re is more upside on <strong>the</strong> horizon once<br />

palm oil prices do recover. In <strong>the</strong> mean time, we recommend investors pick those<br />

with significant volume growth potential. Our top pick is Kencana Agri, given decent<br />

upsides to our DCF valuations.<br />

We are turning positive to <strong>the</strong> consumer goods sector as <strong>the</strong> world economy is<br />

gradually trekking out of recession. We’ve been seeing reports of shortages of<br />

workers for factories in China’s coastal provinces since 3Q09, and stats show that<br />

YoY growth of retail sales in China has improved from its lowest point at 11.6% in<br />

Feb 2009 to 15.4% in Aug 2009. Our top pick for <strong>the</strong> downstream consumer goods<br />

is Pacific Andes Resources. We believe it will benefit from a robust domestic<br />

consumption demand from <strong>the</strong> PRC, given that PRC contributes more than 50% of<br />

<strong>the</strong> Group’s revenue. Valuations are undemanding at c.5.3x on FY10F PER, which is<br />

at a significant discount from peers. Fur<strong>the</strong>rmore, its 65% stake in China Fishery<br />

Group is worth about S$816m, more than <strong>the</strong> market capitalization Pacific Andes<br />

itself (S$765m).<br />

We raise this sector to overweight largely on <strong>the</strong> defensiveness of earnings (land<br />

transport), and recovery of operational earnings (for SPH and SIA). For land<br />

transport, we take <strong>the</strong> view that with a market correction likely, after <strong>the</strong> market<br />

rally for 6 months, <strong>the</strong> preference is for defensive counters like ComfortDelGro. We<br />

like CD given its resilient earnings, coupled with good operational peformance<br />

continuing into 3Q results (from 2Q) on lower oil prices yoy and stronger GBP and<br />

AUD qoq. We believe SPH's ad revenues has seen its worst drop earlier this year and<br />

this is poised to recover in 4Q09/1Q10 in line with <strong>the</strong> economy. Fur<strong>the</strong>rmore, <strong>the</strong>re<br />

could be upside surprise to our final DPS expectation of 13cents, up to a potential of<br />

16 cents. For SIA, we expect demand to improve gradually along with <strong>the</strong> economy,<br />

boosted by <strong>the</strong> upcoming opening of Singapore's two Integrated Resorts. Load<br />

factor and yield should also see an uptrend, as supply has been trimmed industrywide.<br />

UOB<br />

Kencana Agri and Pacific<br />

Andes; Olam, Noble<br />

SIA, SPH and<br />

ComfortDelGro.<br />

Page 50