Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Based on our current plans and business conditions, we believe that our existing cash, cash equivalents and<br />

investments and available credit facilities will be sufficient to satisfy our anticipated cash requirements for at<br />

least the next twelve months. However, we may require additional funds if our revenues or expenses fail to meet<br />

our current projections or to support other purposes and may need to raise additional funds through debt or equity<br />

financing or from other sources. There can be no assurances that additional funding will be available at all, or<br />

that if available, such financing will be obtainable on terms favorable to us.<br />

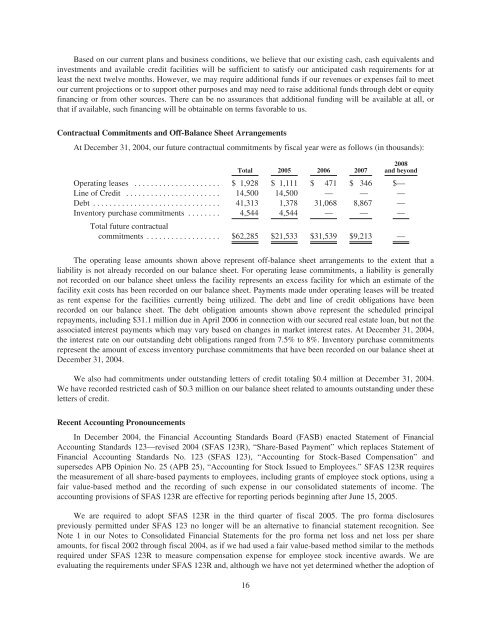

Contractual Commitments and Off-Balance Sheet Arrangements<br />

At December 31, <strong>2004</strong>, our future contractual commitments by fiscal year were as follows (in thousands):<br />

Total 2005 2006 2007<br />

2008<br />

and beyond<br />

Operating leases ..................... $ 1,928 $ 1,111 $ 471 $ 346 $—<br />

Line of Credit ....................... 14,500 14,500 — — —<br />

Debt ............................... 41,313 1,378 31,068 8,867 —<br />

Inventory purchase commitments ........ 4,544 4,544 — — —<br />

Total future contractual<br />

commitments .................. $62,285 $21,533 $31,539 $9,213 —<br />

The operating lease amounts shown above represent off-balance sheet arrangements to the extent that a<br />

liability is not already recorded on our balance sheet. For operating lease commitments, a liability is generally<br />

not recorded on our balance sheet unless the facility represents an excess facility for which an estimate of the<br />

facility exit costs has been recorded on our balance sheet. Payments made under operating leases will be treated<br />

as rent expense for the facilities currently being utilized. The debt and line of credit obligations have been<br />

recorded on our balance sheet. The debt obligation amounts shown above represent the scheduled principal<br />

repayments, including $31.1 million due in April 2006 in connection with our secured real estate loan, but not the<br />

associated interest payments which may vary based on changes in market interest rates. At December 31, <strong>2004</strong>,<br />

the interest rate on our outstanding debt obligations ranged from 7.5% to 8%. Inventory purchase commitments<br />

represent the amount of excess inventory purchase commitments that have been recorded on our balance sheet at<br />

December 31, <strong>2004</strong>.<br />

We also had commitments under outstanding letters of credit totaling $0.4 million at December 31, <strong>2004</strong>.<br />

We have recorded restricted cash of $0.3 million on our balance sheet related to amounts outstanding under these<br />

letters of credit.<br />

Recent Accounting Pronouncements<br />

In December <strong>2004</strong>, the Financial Accounting Standards Board (FASB) enacted Statement of Financial<br />

Accounting Standards 123—revised <strong>2004</strong> (SFAS 123R), “Share-Based Payment” which replaces Statement of<br />

Financial Accounting Standards No. 123 (SFAS 123), “Accounting for Stock-Based Compensation” and<br />

supersedes APB Opinion No. 25 (APB 25), “Accounting for Stock Issued to Employees.” SFAS 123R requires<br />

the measurement of all share-based payments to employees, including grants of employee stock options, using a<br />

fair value-based method and the recording of such expense in our consolidated statements of income. The<br />

accounting provisions of SFAS 123R are effective for reporting periods beginning after June 15, 2005.<br />

We are required to adopt SFAS 123R in the third quarter of fiscal 2005. The pro forma disclosures<br />

previously permitted under SFAS 123 no longer will be an alternative to financial statement recognition. See<br />

Note 1 in our Notes to Consolidated Financial Statements for the pro forma net loss and net loss per share<br />

amounts, for fiscal 2002 through fiscal <strong>2004</strong>, as if we had used a fair value-based method similar to the methods<br />

required under SFAS 123R to measure compensation expense for employee stock incentive awards. We are<br />

evaluating the requirements under SFAS 123R and, although we have not yet determined whether the adoption of<br />

16