Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Purchased Technology<br />

The Company recorded purchased technology related to acquisitions of $9.2 million, and $2.2 million<br />

during the years ended December 31, <strong>2004</strong>, and 2003, respectively. To determine the values of purchased<br />

technology, the expected future cash flows of the existing developed technologies were discounted taking into<br />

account the characteristics and applications of the product, the size of existing markets, growth rates of existing<br />

and future markets, as well as an evaluation of past and anticipated product lifecycles.<br />

(a) Sorrento Networks Corporation<br />

In July <strong>2004</strong>, the Company completed the acquisition of Sorrento Networks Corporation in exchange<br />

for total consideration of $98.0 million, consisting of common stock valued at $57.7 million, options and<br />

warrants to purchase common stock valued at $12.3 million, assumed liabilities of $27.0 million, and<br />

acquisition costs of $1.0 million. The Company acquired Sorrento to obtain its line of optical transport<br />

products and enhance its competitive position with cable operators. One of the Company’s directors is a<br />

partner of a venture capital firm which is a significant stockholder of <strong>Zhone</strong>, and which also held warrants to<br />

purchase Sorrento common stock that were assumed by <strong>Zhone</strong>.<br />

The purchase consideration was allocated to the fair values of the assets acquired as follows: net<br />

tangible assets—$23.4 million, amortizable intangible assets—$14.8 million, purchased in-process research<br />

and development—$2.4 million, goodwill—$57.2 million and deferred compensation—$0.2 million. The<br />

amount allocated to purchased in-process research and development was charged to expense during the third<br />

quarter of <strong>2004</strong>, because technological feasibility had not been established and no future alternative uses for<br />

the technology existed. The estimated fair value of the purchased in-process research and development was<br />

determined using a discounted cash flow model, based on a discount rate which took into consideration the<br />

stage of completion and risks associated with developing the technology. Of the amount allocated to<br />

amortizable intangible assets, $9.2 million was allocated to core technology, which is being amortized over<br />

an estimated useful life of five years. The remaining $5.6 million was allocated to customer relationships,<br />

which is being amortized over an estimated useful life of four years.<br />

Assumed liabilities related to the Sorrento acquisition totaled $27.0 million, the most significant<br />

component of which was long-term debt and debentures totaling $15.8 million. Following the<br />

consummation of the acquisition, the Company sold certain excess facilities acquired from Sorrento. The net<br />

proceeds were used to repay the associated long term debt of $4.1 million and convertible debentures of<br />

$2.5 million. The assumed liabilities also included employee severance and exit costs totaling $1.6 million,<br />

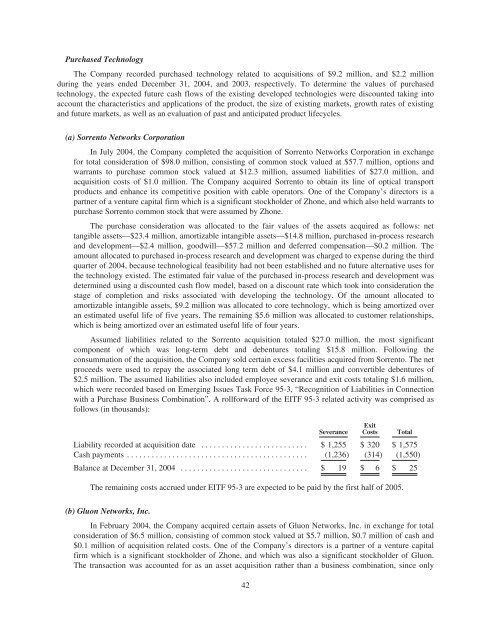

which were recorded based on Emerging Issues Task Force 95-3, “Recognition of Liabilities in Connection<br />

with a Purchase Business Combination”. A rollforward of the EITF 95-3 related activity was comprised as<br />

follows (in thousands):<br />

Severance<br />

Exit<br />

Costs Total<br />

Liability recorded at acquisition date .......................... $1,255 $ 320 $ 1,575<br />

Cash payments ............................................ (1,236) (314) (1,550)<br />

Balance at December 31, <strong>2004</strong> ............................... $ 19 $ 6 $ 25<br />

The remaining costs accrued under EITF 95-3 are expected to be paid by the first half of 2005.<br />

(b) Gluon Networks, Inc.<br />

In February <strong>2004</strong>, the Company acquired certain assets of Gluon Networks, Inc. in exchange for total<br />

consideration of $6.5 million, consisting of common stock valued at $5.7 million, $0.7 million of cash and<br />

$0.1 million of acquisition related costs. One of the Company’s directors is a partner of a venture capital<br />

firm which is a significant stockholder of <strong>Zhone</strong>, and which was also a significant stockholder of Gluon.<br />

The transaction was accounted for as an asset acquisition rather than a business combination, since only<br />

42