Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the fair value of its reporting unit was performed at the Company level using a combination of the income, or<br />

discounted cash flows, approach and the market approach, which utilizes comparable companies’ data. At<br />

November <strong>2004</strong> and 2003, the Company performed the annual goodwill impairment test using the market<br />

approach, reflecting the fact that the Company’s stock was publicly traded following the consummation of the<br />

Tellium merger. No impairment charges have been recorded since the adoption of SFAS No. 142.<br />

At December 31, <strong>2004</strong> and 2003, the Company had goodwill with a carrying value of $157.2 million and<br />

$100.3 million, respectively.<br />

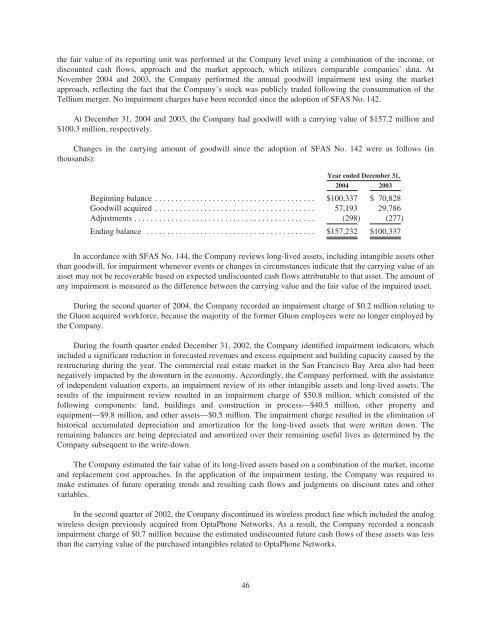

Changes in the carrying amount of goodwill since the adoption of SFAS No. 142 were as follows (in<br />

thousands):<br />

Year ended December 31,<br />

<strong>2004</strong> 2003<br />

Beginning balance ....................................... $100,337 $ 70,828<br />

Goodwill acquired ....................................... 57,193 29,786<br />

Adjustments ............................................ (298) (277)<br />

Ending balance ......................................... $157,232 $100,337<br />

In accordance with SFAS No. 144, the Company reviews long-lived assets, including intangible assets other<br />

than goodwill, for impairment whenever events or changes in circumstances indicate that the carrying value of an<br />

asset may not be recoverable based on expected undiscounted cash flows attributable to that asset. The amount of<br />

any impairment is measured as the difference between the carrying value and the fair value of the impaired asset.<br />

During the second quarter of <strong>2004</strong>, the Company recorded an impairment charge of $0.2 million relating to<br />

the Gluon acquired workforce, because the majority of the former Gluon employees were no longer employed by<br />

the Company.<br />

During the fourth quarter ended December 31, 2002, the Company identified impairment indicators, which<br />

included a significant reduction in forecasted revenues and excess equipment and building capacity caused by the<br />

restructuring during the year. The commercial real estate market in the San Francisco Bay Area also had been<br />

negatively impacted by the downturn in the economy. Accordingly, the Company performed, with the assistance<br />

of independent valuation experts, an impairment review of its other intangible assets and long-lived assets. The<br />

results of the impairment review resulted in an impairment charge of $50.8 million, which consisted of the<br />

following components: land, buildings and construction in process—$40.5 million, other property and<br />

equipment—$9.8 million, and other assets—$0.5 million. The impairment charge resulted in the elimination of<br />

historical accumulated depreciation and amortization for the long-lived assets that were written down. The<br />

remaining balances are being depreciated and amortized over their remaining useful lives as determined by the<br />

Company subsequent to the write-down.<br />

The Company estimated the fair value of its long-lived assets based on a combination of the market, income<br />

and replacement cost approaches. In the application of the impairment testing, the Company was required to<br />

make estimates of future operating trends and resulting cash flows and judgments on discount rates and other<br />

variables.<br />

In the second quarter of 2002, the Company discontinued its wireless product line which included the analog<br />

wireless design previously acquired from OptaPhone Networks. As a result, the Company recorded a noncash<br />

impairment charge of $0.7 million because the estimated undiscounted future cash flows of these assets was less<br />

than the carrying value of the purchased intangibles related to OptaPhone Networks.<br />

46