Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

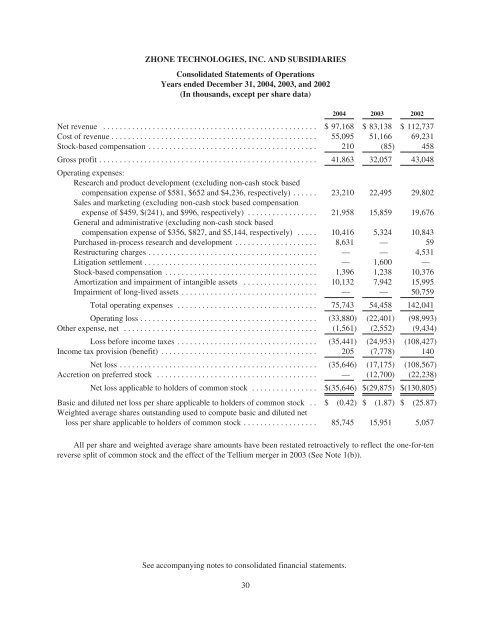

ZHONE TECHNOLOGIES, INC. AND SUBSIDIARIES<br />

Consolidated Statements of Operations<br />

Years ended December 31, <strong>2004</strong>, 2003, and 2002<br />

(In thousands, except per share data)<br />

<strong>2004</strong> 2003 2002<br />

Net revenue .................................................... $97,168 $ 83,138 $ 112,737<br />

Cost of revenue .................................................. 55,095 51,166 69,231<br />

Stock-based compensation ......................................... 210 (85) 458<br />

Gross profit ..................................................... 41,863 32,057 43,048<br />

Operating expenses:<br />

Research and product development (excluding non-cash stock based<br />

compensation expense of $581, $652 and $4,236, respectively) ...... 23,210 22,495 29,802<br />

Sales and marketing (excluding non-cash stock based compensation<br />

expense of $459, $(241), and $996, respectively) ................. 21,958 15,859 19,676<br />

General and administrative (excluding non-cash stock based<br />

compensation expense of $356, $827, and $5,144, respectively) ..... 10,416 5,324 10,843<br />

Purchased in-process research and development .................... 8,631 — 59<br />

Restructuring charges ......................................... — — 4,531<br />

Litigation settlement .......................................... — 1,600 —<br />

Stock-based compensation ..................................... 1,396 1,238 10,376<br />

Amortization and impairment of intangible assets .................. 10,132 7,942 15,995<br />

Impairment of long-lived assets ................................. — — 50,759<br />

Total operating expenses .................................. 75,743 54,458 142,041<br />

Operating loss ........................................... (33,880) (22,401) (98,993)<br />

Other expense, net ............................................... (1,561) (2,552) (9,434)<br />

Loss before income taxes .................................. (35,441) (24,953) (108,427)<br />

Income tax provision (benefit) ...................................... 205 (7,778) 140<br />

Net loss ................................................ (35,646) (17,175) (108,567)<br />

Accretion on preferred stock ....................................... — (12,700) (22,238)<br />

Net loss applicable to holders of common stock ................ $(35,646) $(29,875) $(130,805)<br />

Basic and diluted net loss per share applicable to holders of common stock . . $ (0.42) $ (1.87) $ (25.87)<br />

Weighted average shares outstanding used to compute basic and diluted net<br />

loss per share applicable to holders of common stock .................. 85,745 15,951 5,057<br />

All per share and weighted average share amounts have been restated retroactively to reflect the one-for-ten<br />

reverse split of common stock and the effect of the Tellium merger in 2003 (See Note 1(b)).<br />

See accompanying notes to consolidated financial statements.<br />

30