Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(f) Inventories<br />

Inventories are stated at the lower of cost or market, with cost being determined using the first-in, firstout<br />

(FIFO) method. In assessing the net realizable value of inventories, the Company is required to make<br />

judgments as to future demand requirements and compare these with the current or committed inventory<br />

levels. Once inventory has been written down to its estimated net realizable value, its carrying value cannot<br />

be increased due to subsequent changes in demand forecasts. To the extent that a severe decline in<br />

forecasted demand occurs, or the Company experiences a higher incidence of inventory obsolescence due to<br />

rapidly changing technology and customer requirements, the Company may incur significant charges for<br />

excess inventory.<br />

(g) Restructuring Charges<br />

During 2002, the Company recorded charges of $4.5 million in connection with its restructuring<br />

program in accordance with relevant guidance as summarized in SEC Staff Accounting Bulletin (“SAB”)<br />

No. 100. The related reserves reflected many estimates, including those pertaining to severance and related<br />

charges, facilities and lease cancellations and equipment write-offs. The Company assessed the reserve<br />

requirements to complete each individual plan under its restructuring programs at the end of each reporting<br />

period and recorded any adjustments as appropriate. Future restructuring charges, if any, will be recorded<br />

under the provisions of SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities”<br />

or SFAS No. 112, “Employers Accounting for Post Employment Benefits.” As of December 31, <strong>2004</strong> and<br />

2003, there were no liabilities associated with the Company’s restructuring programs.<br />

(h) Cash and Cash Equivalents and Short Term Investments<br />

The Company considers all cash and highly liquid investments purchased with an original maturity of<br />

less than three months to be cash equivalents.<br />

Short-term investments include securities with original maturities greater than three months and less<br />

than one year. Short-term investments consisting principally of debt securities of domestic municipalities<br />

and corporations have been classified as available-for-sale. Under this classification, the investments are<br />

reported at fair value, with unrealized gains and losses excluded from results of operations and reported, net<br />

of tax, as a component of other comprehensive loss in stockholders’ equity. Realized gains and losses and<br />

declines in value judged to be other than temporary are included in results of operations. Gains and losses<br />

from the sale of securities are based on the specific-identification method.<br />

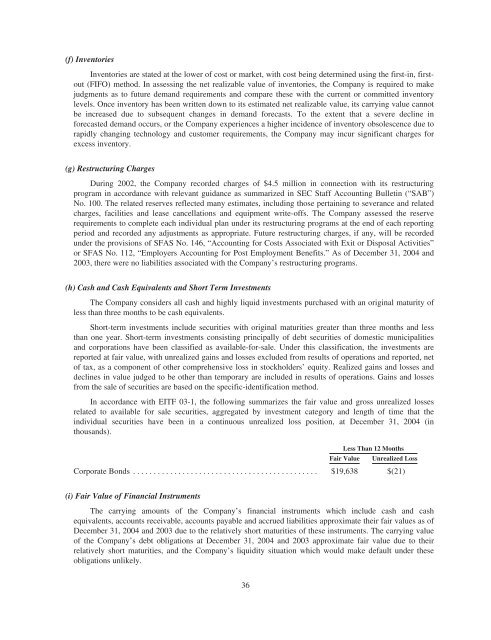

In accordance with EITF 03-1, the following summarizes the fair value and gross unrealized losses<br />

related to available for sale securities, aggregated by investment category and length of time that the<br />

individual securities have been in a continuous unrealized loss position, at December 31, <strong>2004</strong> (in<br />

thousands).<br />

Less Than 12 Months<br />

Fair Value Unrealized Loss<br />

Corporate Bonds ............................................. $19,638 $(21)<br />

(i) Fair Value of Financial Instruments<br />

The carrying amounts of the Company’s financial instruments which include cash and cash<br />

equivalents, accounts receivable, accounts payable and accrued liabilities approximate their fair values as of<br />

December 31, <strong>2004</strong> and 2003 due to the relatively short maturities of these instruments. The carrying value<br />

of the Company’s debt obligations at December 31, <strong>2004</strong> and 2003 approximate fair value due to their<br />

relatively short maturities, and the Company’s liquidity situation which would make default under these<br />

obligations unlikely.<br />

36