Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Zhone Technologies Annual Report 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

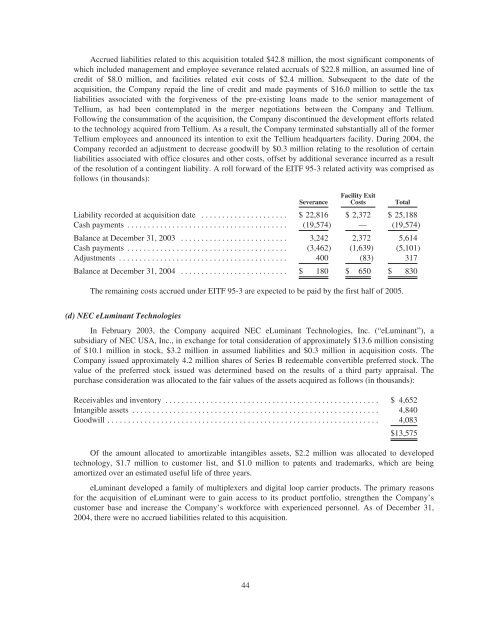

Accrued liabilities related to this acquisition totaled $42.8 million, the most significant components of<br />

which included management and employee severance related accruals of $22.8 million, an assumed line of<br />

credit of $8.0 million, and facilities related exit costs of $2.4 million. Subsequent to the date of the<br />

acquisition, the Company repaid the line of credit and made payments of $16.0 million to settle the tax<br />

liabilities associated with the forgiveness of the pre-existing loans made to the senior management of<br />

Tellium, as had been contemplated in the merger negotiations between the Company and Tellium.<br />

Following the consummation of the acquisition, the Company discontinued the development efforts related<br />

to the technology acquired from Tellium. As a result, the Company terminated substantially all of the former<br />

Tellium employees and announced its intention to exit the Tellium headquarters facility. During <strong>2004</strong>, the<br />

Company recorded an adjustment to decrease goodwill by $0.3 million relating to the resolution of certain<br />

liabilities associated with office closures and other costs, offset by additional severance incurred as a result<br />

of the resolution of a contingent liability. A roll forward of the EITF 95-3 related activity was comprised as<br />

follows (in thousands):<br />

Severance<br />

Facility Exit<br />

Costs Total<br />

Liability recorded at acquisition date ..................... $22,816 $ 2,372 $ 25,188<br />

Cash payments ....................................... (19,574) — (19,574)<br />

Balance at December 31, 2003 .......................... 3,242 2,372 5,614<br />

Cash payments ....................................... (3,462) (1,639) (5,101)<br />

Adjustments ......................................... 400 (83) 317<br />

Balance at December 31, <strong>2004</strong> .......................... $ 180 $ 650 $ 830<br />

The remaining costs accrued under EITF 95-3 are expected to be paid by the first half of 2005.<br />

(d) NEC eLuminant <strong>Technologies</strong><br />

In February 2003, the Company acquired NEC eLuminant <strong>Technologies</strong>, Inc. (“eLuminant”), a<br />

subsidiary of NEC USA, Inc., in exchange for total consideration of approximately $13.6 million consisting<br />

of $10.1 million in stock, $3.2 million in assumed liabilities and $0.3 million in acquisition costs. The<br />

Company issued approximately 4.2 million shares of Series B redeemable convertible preferred stock. The<br />

value of the preferred stock issued was determined based on the results of a third party appraisal. The<br />

purchase consideration was allocated to the fair values of the assets acquired as follows (in thousands):<br />

Receivables and inventory .................................................... $ 4,652<br />

Intangible assets ............................................................ 4,840<br />

Goodwill .................................................................. 4,083<br />

$13,575<br />

Of the amount allocated to amortizable intangibles assets, $2.2 million was allocated to developed<br />

technology, $1.7 million to customer list, and $1.0 million to patents and trademarks, which are being<br />

amortized over an estimated useful life of three years.<br />

eLuminant developed a family of multiplexers and digital loop carrier products. The primary reasons<br />

for the acquisition of eLuminant were to gain access to its product portfolio, strengthen the Company’s<br />

customer base and increase the Company’s workforce with experienced personnel. As of December 31,<br />

<strong>2004</strong>, there were no accrued liabilities related to this acquisition.<br />

44