Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

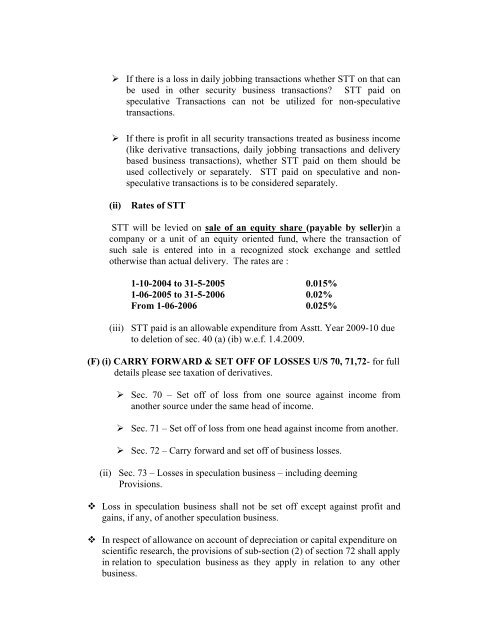

‣ If there is a loss in daily jobbing transactions whether STT on that can<br />

be used in other security business transactions? STT paid on<br />

speculative <strong>Transactions</strong> can not be utilized for non-speculative<br />

transactions.<br />

‣ If there is profit in all security transactions treated as business income<br />

(like derivative transactions, daily jobbing transactions and delivery<br />

based business transactions), whether STT paid on them should be<br />

used collectively or separately. STT paid on speculative and nonspeculative<br />

transactions is <strong>to</strong> be considered separately.<br />

(ii)<br />

Rates of STT<br />

STT will be levied on sale of an equity share (payable by seller)in a<br />

company or a unit of an equity oriented fund, where the transaction of<br />

such sale is entered in<strong>to</strong> in a recognized s<strong>to</strong>ck exchange and settled<br />

otherwise than actual delivery. The rates are :<br />

1-10-2004 <strong>to</strong> 31-5-2005 0.015%<br />

1-06-2005 <strong>to</strong> 31-5-2006 0.02%<br />

From 1-06-2006 0.025%<br />

(iii) STT paid is an allowable expenditure from Asstt. Year 2009-10 due<br />

<strong>to</strong> deletion of sec. 40 (a) (ib) w.e.f. 1.4.2009.<br />

(F) (i) CARRY FORWARD & SET OFF OF LOSSES U/S 70, 71,72- for full<br />

details please see taxation of derivatives.<br />

‣ Sec. 70 – Set off of loss from one source against income from<br />

another source under the same head of income.<br />

‣ Sec. 71 – Set off of loss from one head against income from another.<br />

‣ Sec. 72 – Carry forward and set off of business losses.<br />

(ii) Sec. 73 – Losses in speculation business – including deeming<br />

Provisions.<br />

Loss in speculation business shall not be set off except against profit and<br />

gains, if any, of another speculation business.<br />

In respect of allowance on account of depreciation or capital expenditure on<br />

scientific research, the provisions of sub-section (2) of section 72 shall apply<br />

in relation <strong>to</strong> speculation business as they apply in relation <strong>to</strong> any other<br />

business.