Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

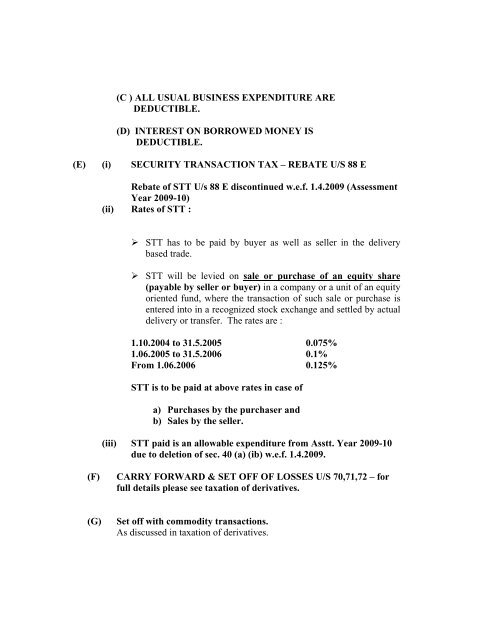

(C ) ALL USUAL BUSINESS EXPENDITURE ARE<br />

DEDUCTIBLE.<br />

(D) INTEREST ON BORROWED MONEY IS<br />

DEDUCTIBLE.<br />

(E) (i) SECURITY TRANSACTION TAX – REBATE U/S 88 E<br />

Rebate of STT U/s 88 E discontinued w.e.f. 1.4.2009 (Assessment<br />

Year 2009-10)<br />

(ii) Rates of STT :<br />

‣ STT has <strong>to</strong> be paid by buyer as well as seller in the delivery<br />

based trade.<br />

‣ STT will be levied on sale or purchase of an equity share<br />

(payable by seller or buyer) in a company or a unit of an equity<br />

oriented fund, where the transaction of such sale or purchase is<br />

entered in<strong>to</strong> in a recognized s<strong>to</strong>ck exchange and settled by actual<br />

delivery or transfer. The rates are :<br />

1.10.2004 <strong>to</strong> 31.5.2005 0.075%<br />

1.06.2005 <strong>to</strong> 31.5.2006 0.1%<br />

From 1.06.2006 0.125%<br />

STT is <strong>to</strong> be paid at above rates in case of<br />

a) Purchases by the purchaser and<br />

b) Sales by the seller.<br />

(iii) STT paid is an allowable expenditure from Asstt. Year 2009-10<br />

due <strong>to</strong> deletion of sec. 40 (a) (ib) w.e.f. 1.4.2009.<br />

(F)<br />

CARRY FORWARD & SET OFF OF LOSSES U/S 70,71,72 – for<br />

full details please see taxation of derivatives.<br />

(G)<br />

Set off with commodity transactions.<br />

As discussed in taxation of derivatives.