Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(i)<br />

(ii)<br />

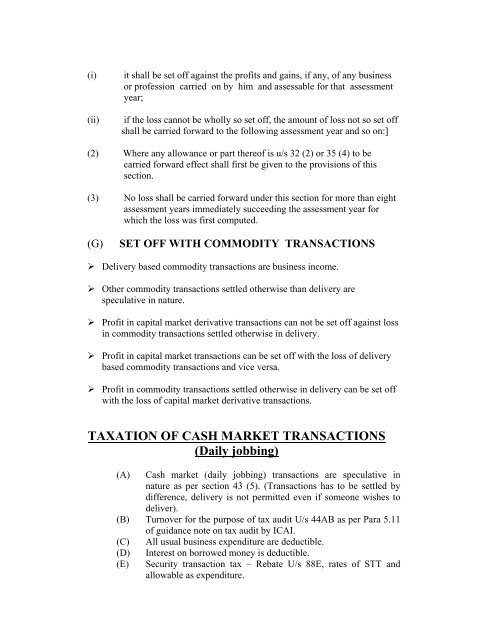

it shall be set off against the profits and gains, if any, of any business<br />

or profession carried on by him and assessable for that assessment<br />

year;<br />

if the loss cannot be wholly so set off, the amount of loss not so set off<br />

shall be carried forward <strong>to</strong> the following assessment year and so on:]<br />

(2) Where any allowance or part thereof is u/s 32 (2) or 35 (4) <strong>to</strong> be<br />

carried forward effect shall first be given <strong>to</strong> the provisions of this<br />

section.<br />

(3) No loss shall be carried forward under this section for more than eight<br />

assessment years immediately succeeding the assessment year for<br />

which the loss was first computed.<br />

(G)<br />

SET OFF WITH COMMODITY TRANSACTIONS<br />

‣ Delivery based commodity transactions are business income.<br />

‣ Other commodity transactions settled otherwise than delivery are<br />

speculative in nature.<br />

‣ Profit in capital market derivative transactions can not be set off against loss<br />

in commodity transactions settled otherwise in delivery.<br />

‣ Profit in capital market transactions can be set off with the loss of delivery<br />

based commodity transactions and vice versa.<br />

‣ Profit in commodity transactions settled otherwise in delivery can be set off<br />

with the loss of capital market derivative transactions.<br />

TAXATION OF CASH MARKET TRANSACTIONS<br />

(Daily jobbing)<br />

(A) Cash market (daily jobbing) transactions are speculative in<br />

nature as per section 43 (5). (<strong>Transactions</strong> has <strong>to</strong> be settled by<br />

difference, delivery is not permitted even if someone wishes <strong>to</strong><br />

deliver).<br />

(B) Turnover for the purpose of tax audit U/s 44AB as per Para 5.11<br />

of guidance note on tax audit by ICAI.<br />

(C) All usual business expenditure are deductible.<br />

(D)<br />

(E)<br />

Interest on borrowed money is deductible.<br />

Security transaction tax – Rebate U/s 88E, rates of STT and<br />

allowable as expenditure.