Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

‣ Cost of acquisition in the cases given in sec. 49 such as gift, will<br />

etc. will be the cost <strong>to</strong> the previous owner.<br />

‣ If asset acquired prior <strong>to</strong> 1.4.81 at the option of the assessee<br />

actual cost of acquisitioner or <strong>Market</strong> value as on 1.4.1981<br />

whichever suits him will be the cost of acquisition .<br />

‣ For determining whether an asset is long term or short term<br />

period of holding of previous owner will be considered in cases<br />

covered U/s 49 such as gift, will etc.<br />

‣ Indexation of cost of acquisition is <strong>to</strong> be considered as given in<br />

sec. 48 explanation (iii).<br />

‣ Period of holding in the cases covered U/s 49 such as gift, will<br />

etc. for indexation of cost of acquisition is disputable.<br />

(i) From the date of acquisition of previous owner –<br />

Pushpa so far 81 ITDI (ITAT-Chd).<br />

(ii) From the date of inheritance – Kishore kanvngo<br />

102 ITD 437 (ITAT-MUM).<br />

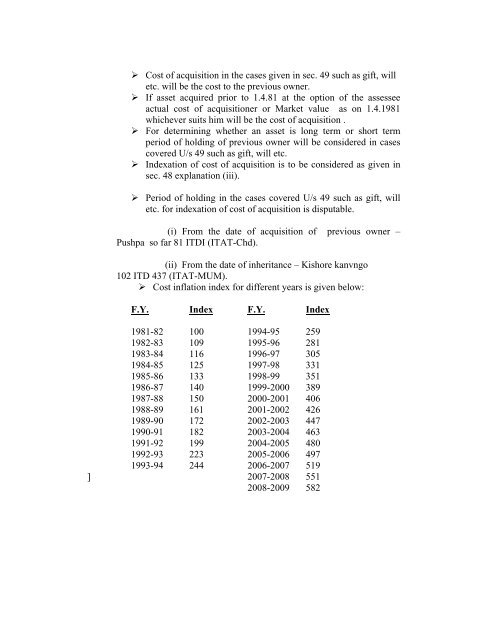

‣ Cost inflation index for different years is given below:<br />

F.Y. Index F.Y. Index<br />

1981-82 100 1994-95 259<br />

1982-83 109 1995-96 281<br />

1983-84 116 1996-97 305<br />

1984-85 125 1997-98 331<br />

1985-86 133 1998-99 351<br />

1986-87 140 1999-2000 389<br />

1987-88 150 2000-2001 406<br />

1988-89 161 2001-2002 426<br />

1989-90 172 2002-2003 447<br />

1990-91 182 2003-2004 463<br />

1991-92 199 2004-2005 480<br />

1992-93 223 2005-2006 497<br />

1993-94 244 2006-2007 519<br />

] 2007-2008 551<br />

2008-2009 582