Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

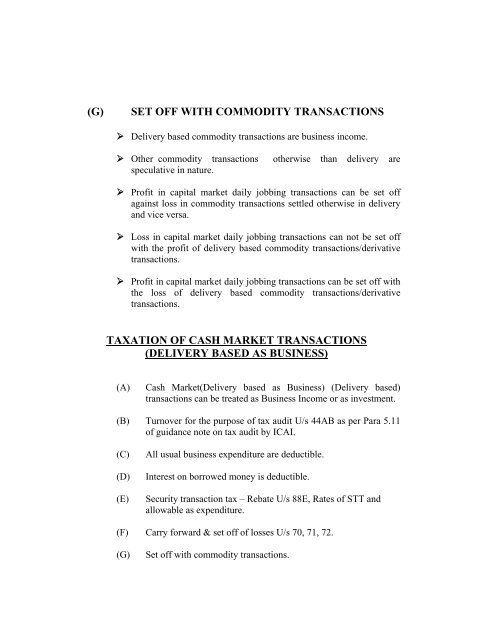

(G)<br />

SET OFF WITH COMMODITY TRANSACTIONS<br />

‣ Delivery based commodity transactions are business income.<br />

‣ Other commodity transactions<br />

speculative in nature.<br />

otherwise than delivery are<br />

‣ Profit in capital market daily jobbing transactions can be set off<br />

against loss in commodity transactions settled otherwise in delivery<br />

and vice versa.<br />

‣ Loss in capital market daily jobbing transactions can not be set off<br />

with the profit of delivery based commodity transactions/derivative<br />

transactions.<br />

‣ Profit in capital market daily jobbing transactions can be set off with<br />

the loss of delivery based commodity transactions/derivative<br />

transactions.<br />

TAXATION OF CASH MARKET TRANSACTIONS<br />

(DELIVERY BASED AS BUSINESS)<br />

(A)<br />

Cash <strong>Market</strong>(Delivery based as Business) (Delivery based)<br />

transactions can be treated as Business Income or as investment.<br />

(B) Turnover for the purpose of tax audit U/s 44AB as per Para 5.11<br />

of guidance note on tax audit by ICAI.<br />

(C)<br />

(D)<br />

(E)<br />

All usual business expenditure are deductible.<br />

Interest on borrowed money is deductible.<br />

Security transaction tax – Rebate U/s 88E, Rates of STT and<br />

allowable as expenditure.<br />

(F) Carry forward & set off of losses U/s 70, 71, 72.<br />

(G)<br />

Set off with commodity transactions.