Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

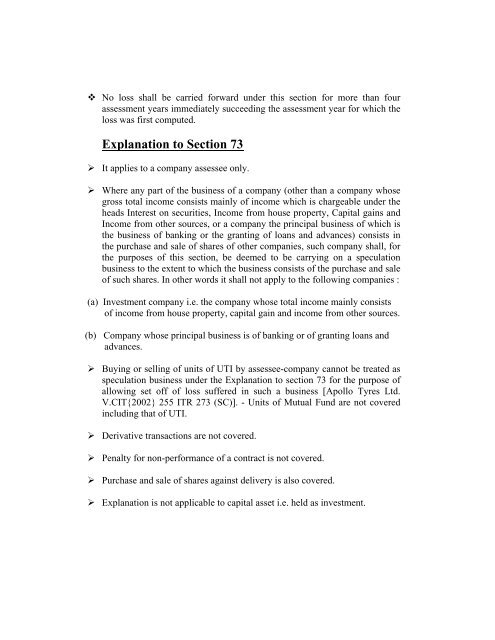

No loss shall be carried forward under this section for more than four<br />

assessment years immediately succeeding the assessment year for which the<br />

loss was first computed.<br />

Explanation <strong>to</strong> Section 73<br />

‣ It applies <strong>to</strong> a company assessee only.<br />

‣ Where any part of the business of a company (other than a company whose<br />

gross <strong>to</strong>tal income consists mainly of income which is chargeable under the<br />

heads Interest on securities, Income from house property, <strong>Capital</strong> gains and<br />

Income from other sources, or a company the principal business of which is<br />

the business of banking or the granting of loans and advances) consists in<br />

the purchase and sale of shares of other companies, such company shall, for<br />

the purposes of this section, be deemed <strong>to</strong> be carrying on a speculation<br />

business <strong>to</strong> the extent <strong>to</strong> which the business consists of the purchase and sale<br />

of such shares. In other words it shall not apply <strong>to</strong> the following companies :<br />

(a) Investment company i.e. the company whose <strong>to</strong>tal income mainly consists<br />

of income from house property, capital gain and income from other sources.<br />

(b) Company whose principal business is of banking or of granting loans and<br />

advances.<br />

‣ Buying or selling of units of UTI by assessee-company cannot be treated as<br />

speculation business under the Explanation <strong>to</strong> section 73 for the purpose of<br />

allowing set off of loss suffered in such a business [Apollo Tyres Ltd.<br />

V.CIT{2002} 255 ITR 273 (SC)]. - Units of Mutual Fund are not covered<br />

including that of UTI.<br />

‣ Derivative transactions are not covered.<br />

‣ Penalty for non-performance of a contract is not covered.<br />

‣ Purchase and sale of shares against delivery is also covered.<br />

‣ Explanation is not applicable <strong>to</strong> capital asset i.e. held as investment.